Industry Update Articles

Securities Industry Essentials (SIE) Exam: Frequently Asked Questions for Businesses

The introduction of FINRA’s Securities Industry Essentials (SIE) exam in October 2018 fundamentally changed the securities licensing process. Today, firms continue to navigate these changes, benefiting from the restructuring while adapting their strategies. We've compiled and answered some of the most common questions we hear from our partner firms.

How Does The SIE Exam Impact Your Firm’s Recruitment Efforts Today?

FINRA's restructuring of securities exams offers many potential benefits, particularly for firms aiming to enhance efficiency in their recruiting and onboarding processes. Your firm currently has several strategic options when bringing on new representatives. You can make passing the SIE exam a condition of employment, require new hires to pass the SIE exam before they take a specialized knowledge exam, or even have new hires take both exams concurrently.

How Does The SIE Exam Affect Your Onboarding Process?

Candidates now must pass multiple exams before they can register with FINRA. This reality can extend the onboarding process, as it requires accounting for exam scheduling, testing, and potential waiting periods for retakes.

How Can Your Firm Strategically Use This Revised Structure to Your Advantage?

Thinking strategically, the SIE exam continues to allow firms to create pipelines of qualified candidates. This can lead to reduced onboarding and recruiting costs, increased speed to production, and the development of more agile and effective workforces.

Can Your Firm Partner With an SIE Exam Prep Education Provider?

Yes. Many training providers offer exam preparation courses and programs specifically designed to assist students with passing both the SIE exam and subsequent qualification exams. Kaplan, for instance, continues to offer online classroom and blended self-study exam prep programs, supporting tens of thousands of successful candidates annually.

These proven approaches are widely used to implement SIE-related programs within numerous universities, many of which Kaplan partners with for CFP® certification education and CFA®-based curricula, as well as with thousands of corporate partners. Our integrated strategy focuses on connecting these universities with potential employers to provide sources of highly qualified candidates, while simultaneously preparing individuals to pass the SIE and qualification exams and supporting their ongoing careers in the securities industry.

Can Firms Use a Candidate’s Passing Of The SIE Exam as a Reliable Predictor Of How They Will Perform On Their Qualification Exams?

While a candidate successfully passing the SIE exam demonstrates mastery of basic industry knowledge and proficiency in handling a high-stakes exam experience, it has become clear over the years that there isn't a direct or simple correlation to how they will perform on their respective qualification exams. While foundational knowledge is essential, the specialized exams require candidates to further apply this knowledge with a deeper, more specific approach.

How To Adapt Your Internal Training Program & Process to Accommodate The SIE Exam

You have several options for onboarding new hires:

- Hire applicants who have already successfully passed the SIE exam.

- Onboard individuals and require them to take the SIE exam prior to their qualification exam.

- Request new hires to take both the SIE and qualification exams together.

Additionally, many of the firms Kaplan partners with on corporate training programs continue to express interest in leveraging the SIE exam for their non-registered administrative employees. A deeper understanding of the industry among all staff contributes to more agile and effective workforces, which remains key to growth and competitive positioning.

What Are The Benefits Of These Changes For Companies Today?

By creating pipelines of candidates who have demonstrated mastery of fundamental securities-related knowledge, firms are able to reduce costs associated with recruiting and licensing. Crucially, firms can mitigate the drain on productivity often experienced when bringing on new hires. Firms that currently have, or plan to develop, relationships with local universities continue to hold an advantage in leveraging the benefits of this exam. As noted, many firms are still interested in having their administrative staff prepare for and sit for the SIE exam as well.

What Are The Challenges Presented By The SIE Exam Today?

One concern that emerged and continues to be addressed is the potential for individuals who have passed the SIE exam to misrepresent their qualifications to investors. In response, FINRA implemented SIE Rules of Conduct requiring individuals to attest that they are not qualified to conduct securities business with the public until they meet the additional requirements of being associated with a firm and passing a specialized knowledge exam.

Additionally, candidates still need to pass multiple exams before registering with FINRA, which can extend the onboarding process to account for exam scheduling, testing, and waiting periods for retakes.

Finally, for those firms who choose to hire individuals without the SIE credential, the total cost in terms of exam fees has grown significantly since 2018, and is expected to sharply increase again soon.

Hopefully this article has helped clear up confusion and answer any questions you have about the SIE Exam's continued impact on your firm. If you're looking for more information, you can access our SIE Information Center. We also continue to offer FAQs for candidates and universities to answer SIE-specific questions.

NASAA Adopts Investment Adviser Representative Continuing Education Model Rule

The Continuing Education Model Rule for Investment Adviser Representatives (IARs) has multiple implications and effects for professionals throughout the financial services industry. Read more about the IAR Continuing Education (CE) Model Rule, who it will impact, where it is in effect, related requirements, and more.

What is Investment Adviser Representative Continuing Education (IAR CE?)

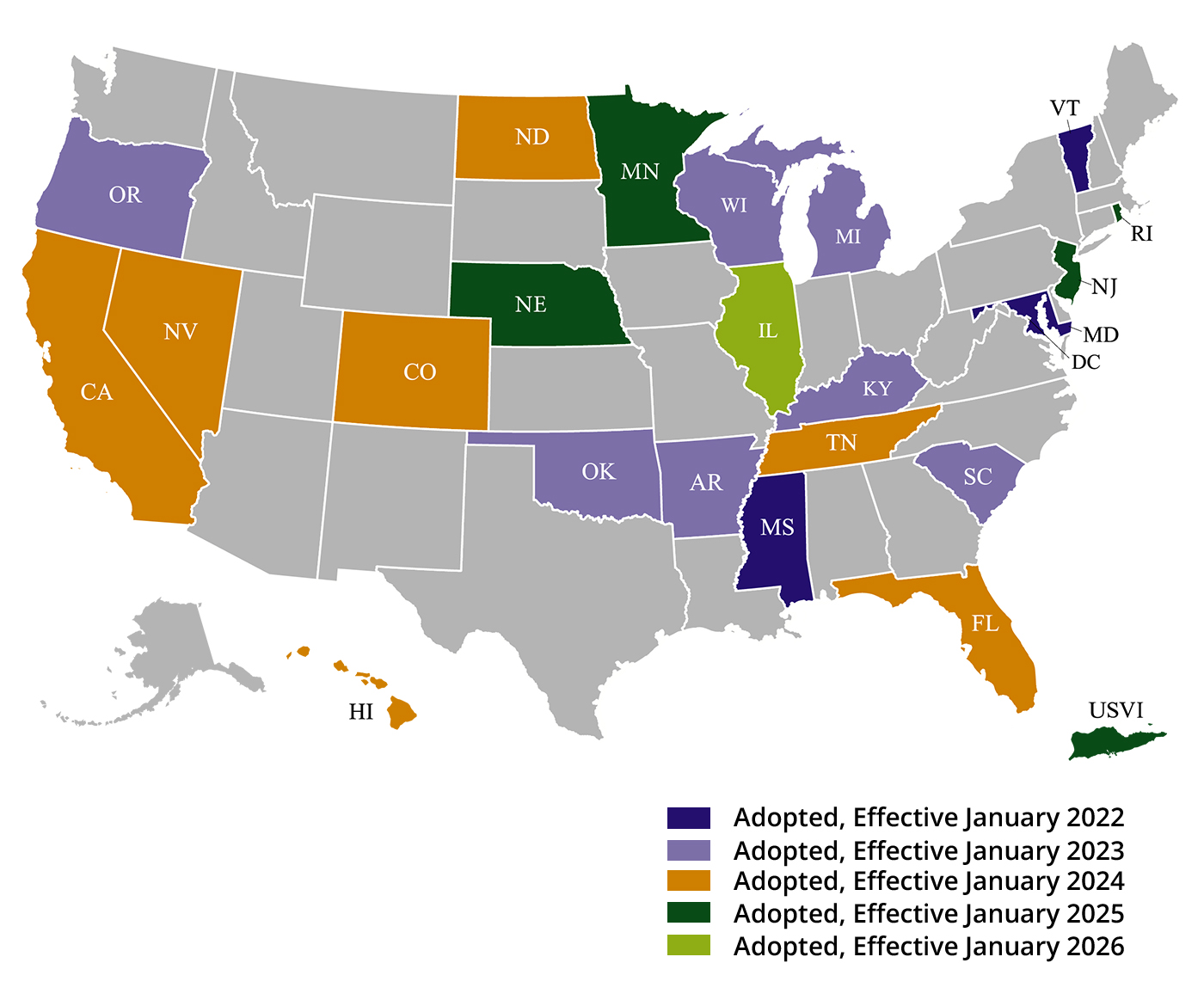

IAR CE is an annual continuing education requirement for IARs governed by the NASAA Model Rule on Continuing Education which was adopted in 2020 and implemented by states and jurisdictions beginning in 2022.

Why Was the IAR CE Model Rule Adopted?

NASAA’s membership, with strong industry support, adopted the IAR CE Model Rule to address the lack of a continuing education requirement for IARs in contrast to other financial services professionals. These types of professionals are often required to maintain or expand their level of knowledge and competence after initial qualification, which is what the IAR CE Model Rule will now accomplish for IARs.

Who is the IAR CE For?

Any Investment Adviser Representative (IAR) who is registered in a state or jurisdiction that has adopted the NASAA IAR CE Model Rule will be subject to its new CE requirements.

FINRA and IAR CE

For dual registrants, IARs who are also registered agents of BD firms, completion of the FINRA CE Regulatory Element may be applied to meet the Products and Practices component of the IAR CE requirement.

FINRA CE Firm Element training may also be applied to meet the IAR CE requirement if the training is approved by NASAA.

Professional Designation CE courses (CFP®, ChFC®, CFA®, PFS, CIC) are also eligible for IAR CE credit as long as they are approved by NASAA.

When Did the IAR CE Model Rule Go Into Effect?

The IAR CE Model Rule went into effect beginning in 2022.

State by State: Where is the IAR CE Model Rule in Effect?

State | Status | Effective Date |

Mississippi | Adopted | January 1, 2022 |

Vermont | Adopted | January 1, 2022 |

Maryland | Adopted | January 1, 2022 |

Michigan | Adopted | January 1, 2023 |

Wisconsin | Adopted | January 1, 2023 |

Kentucky | Adopted | January 1, 2023 |

| Oklahoma | Adopted | January 1, 2023 |

| Washington DC | Adopted | January 1, 2023 |

| South Carolina | Adopted | January 1, 2023 |

| Arkansas | Adopted | January 1, 2023 |

| Oregon | Adopted | January 1, 2023 |

| Colorado | Adopted | January 1, 2024 |

| Tennessee | Adopted | January 1, 2024 |

| Nevada | Adopted | January 1, 2024 |

| Florida | Adopted | January 1, 2024 |

| North Dakota | Adopted | January 1, 2024 |

| California | Adopted | January 1, 2024 |

| Hawaii | Adopted | January 1, 2024 |

| US Virgin Islands | Adopted | January 1, 2025 |

| Rhode Island | Adopted | January 1, 2025 |

| New Jersey | Adopted | January 1, 2025 |

| Nebraska | Adopted | January 1, 2025 |

| Minnesota | Adopted | January 1, 2025 |

| Illinois | Adopted | January 1, 2026 |

IAR CE Requirements

IARs are required to complete 12 hours of CE credit per year in order to maintain their IAR registration. This includes 6 hours of Products and Practices and 6 hours of Ethics and Professional Responsibility. An IAR taking more than 12 credit hours per year is not allowed to carry forward those excess credits into the following year.

Courses cannot be repeated. CRD tracking will include duplicate courses in the course transcript section if reported, but duplicate courses will not count toward the IAR CE requirement, even if completed in another year.

Kaplan provides both individual courses and a Total Access CE Library to help you fulfill this requirement.

What's the Deadline for Submitting Course Completion Rosters to Ensure They're Processed in 2025?

December 26th, 2025 at 4:00 pm ET. Any rosters submitted before this date will be processed as part of the 2025 renewal process. You must complete your CE courses prior to this date to ensure they are reported before the end of the year.

Can Course Rosters Still Be Submitted Between December 26th After 4:00 pm ET and December 31st, 2025?

Yes, the system will accept rosters during this time. However, they won't be processed until the system resumes operation on January 2nd, 2026, and registration statuses for individuals who are CE Inactive at 4:00 pm on December 26th will immediately advance to Fail to Renew (FTR). If an individual is FTR due to deficient CE on December 26th, their registration status will not update and will remain FTR until the CE deficiency is cleared and a new U4 is filed to re-register with the state.

Will Your 2026 Registration Be Affected if You Wait Until the System Downtime to Complete Your CE?

Expert Tip: It's crucial to stay on top of CE requirements and meet all deadlines to avoid registration issues.

Approved IAR CE Course Providers

IARs are required to take NASAA-approved CE courses from approved course providers. Any vendor, firm, individual, or state may provide CE so long as the provider and course are approved. The list of approved course providers—including Kaplan—can be found here.

IAR CE Costs

NASAA has implemented a course reporting fee of $3 per credit hour. Therefore in addition to any training costs, an IAR can expect to pay $36 per year to meet their CE requirement.

How Can I Check My IAR CE Status?

You can use the Financial Professional Gateway (FinPro) to review your IAR CE status, track completed courses, and more.

Learn more about Kaplan's course offerings here.

SEC Shortening Trade Settlement Cycle from T+2 to T+1

The SEC announced in 2023 that trade settlement will be reduced from T+2 to T+1 in 2024. The SEC set compliance with the new T+1 rule to begin on May 28, 2024. The 15-month period was given to provide time for firms to make the needed adjustments to comply with the new rule. The self-regulatory organizations (e.g., FINRA, MSRB, OCC) have adopted this change as well.

What is the Settlement Cycle?

When selling or purchasing securities there is a cutoff date when the securities traded must be delivered by the selling side and paid for by the purchasing side. That date for most corporate securities is fixed under a set of rules called the Uniform Practice Code. Regulators and the various stock exchanges all agree to operate under this code. The most common settlement arrangement is called regular way and it currently calls for settlement on the second business day from the trade date; what is commonly known as T+2.

When is the Settlement Cycle being Shortened from T+2 to T+1?

With the passage of the Securities Acts Amendments of 1975, Congress empowered the SEC with the authority to change the trade settlement cycle. Eighteen years later, in 1993, the Commission used that authority to again shorten the settlement cycle from T+5 business days to T+3. The SEC then shortened from T+3 to T+2 on the first full day of spring, 2017. The change in 2024 is the first alteration of the settlement cycle since then.

Why is the Settlement Cycle being Shortened from T+2 to T+1?

Benefits of the Settlement Cycle being Shortened from T+2 to T+1

The pandemic year of 2021 intensified the strain of volatility and trading volume, coupled with the enormous number of transactions in “meme” stocks. With that volume came higher margin requirements on retail brokerage, leading to restricted trading in those stocks, leaving some investors unable to purchase stocks at a critical time.

The Commission is confident that shortening the settlement cycle—from T+2 to T+1, plus the corresponding move to accelerate settlement to T+0—as technology allows will further

enhance our trading markets.

Concerns about the Settlement Cycle being Shortened from T+2 to T+1

Apart from the more widely understood future need to deliver securities and funds one day earlier, there are other concerns to the shortened cycle, which includes:

- Fails-to-deliver

- Fails-to-receive

- the process of reclamation

- Regulation SHO

- Buy-ins

- sell-outs and

- other settlement methods such as DVP/RVP.

These are just some of the issues that are affected by the change and appear on certain qualification exams.

How Member Firms Must Respond to the Shortened Settlement Cycle

Because settlement weaves itself throughout industry practices and processes, we at Kaplan will be looking at the hundreds of ways shortened settlement will impact Licensing Exam Manuals and practice test questions through our many study programs. The day T+1 goes into effect, we will be ready, and our students may look forward to being fully equipped with the latest, most up-to-date materials.

NAIC Adopts Best Interest Standard

In February 2020, NAIC enacted its own best interest standard as a revision to its regulation 275. In a press release, NAIC describes it like this: “All recommendations by agents and insurers must be in the best interest of the consumer and ... agents and carriers may not place their financial interest ahead of the consumer’s interest in making the recommendation.” The rule requires that agents and carriers act with “reasonable diligence, care, and skill” in making recommendations.

In the time since the NAIC published the new guidelines, many of the states have adopted the requirement, while others are expected to in the future.

Best Interest Standard Definition

Best interest is a term used in a number of situations including the medical and legal fields. In the financial sector it means setting aside any personal beliefs or biases and working for the good of the client at all times. It goes beyond recommending what may be a good fit and finding the best fit.

The NAIC Best Interest Standard Protects Annuity Consumers

The updated NAIC Annuity standard requires insurance producers to recommend annuities that are not only suitable for the client, but are in the clients best interest. For example, if you are looking for a new car to use for your daily commute virtually any automobile is suitable for your needs. However not all automobiles are in your best interest. To determine your best interest the automobile dealer needs to understand more about you, your needs and your wants. They would need to document those needs and wants and disclose any conflicts of interest they may have. This may even require that dealer to recommend an automobile sold by another dealership.

About NAIC Model Regulation

NAIC Model Regulation for Suitability in Annuity Transactions

- Care

- Disclosure

- Conflict of interest

- Documentation

- Know the consumer’s financial situation, insurance needs and financial objectives.

- Understand the available recommendation options.

- Have a reasonable basis to believe the recommended option effectively addresses the consumer’s financial situation, insurance needs and financial objectives.

- Communicate the basis of the recommendation to the consumer.

- Disclose their role in the transaction, their compensation, and any material conflicts of interest.

- Document, in writing, any recommendation and the justification for such recommendation.

NAIC Suitability in Annuity Transactions: Model Regulation Training Requirements

States Adopting and Proposing NAIC Requirements and Courses

Kaplan has been following the progression of the NAIC Best Interest Rule, along with any other standards individual states adopt. We encourage you to follow along. As each state adopts the new requirement they become part of each state’s insurance continuing education, we are adding the 1-hour and 4-hour courses will also add them to our insurance CE library for that state.

Latest NASAA Exam Updates

On February 6, 2023, the North American Securities Administrators Association (NASAA) announced changes to three exams. The Series 63, 65, and 66 exams will have updated content coverage and topic weightings for any exam administered on or after June 12, 2023.

More information about preparing for the Series 63 Exam Prep

More information about preparing for the Series 65 Exam Prep

More information about preparing for the Series 66 Exam Prep

Series 63, Series 65, and Series 66 Exam Weight Changes

Below are the current exam weights for each topic and what the new topic weights will be after the changes are made on or after June 12, 2023.

Series 63 Exam Topic Weight Changes

Curriculum Topic | Current Topic Weight and Number of Questions | New Topic Weight and Number of Questions |

Regulation of Investment Advisers Including State-Registered and Federal | 5%, 3 | 5%, 3 |

Regulation of Investment Adviser Representatives | 5%, 3 | 5%, 3 |

Regulation of Broker-Dealers | 15%, 9 | 12%, 7 |

Regulation of Agents of Broker-Dealers | 15%, 9 | 13%, 8 |

Regulation of Securities and Issuers | 5%, 3 | 9%, 5 |

Remedies and Administrative Provisions | 10%, 6 | 11%, 7 |

Communication with Customers and Prospects | 20%, 12 | 20%, 12 |

Ethical Practices and Obligations | 25%, 15 | 25%, 15 |

Series 65 Exam Topic Weight Changes

Curriculum Topic | Current Topic Weight and Number of Questions | New Topic Weight and Number of Questions |

Economic Factors and Business Information | 15%, 20 | No Changes |

Investment Vehicle Characteristics | 25%, 32 | No Changes |

Client Investment Recommendations and Strategies | 30%, 39 | No Changes |

Laws, Regulations, and Guidelines Including Prohibition on Unethical Business Practices | 30%, 39 | No Changes |

Series 66 Exam Topic Weight Changes

Curriculum Topic | Current Topic Weight and Number of Questions | New Topic Weight and Number of Questions |

Economic Factors and Business Information | 5%, 5 | 8%, 8 |

Investment Vehicle Characteristics | 20%, 20 | 17%, 17 |

Client/Customer Investment Recommendations and Strategies | 30%, 30 | 30%, 30 |

Laws, Regulations, and Guidelines Including Prohibition on Unethical Business Practices | 45%, 45 | 45%, 45 |

Series 63, 65, and 66 Exam Question Changes

The total number of questions on the Series 63, 65, and 66 exams are not changing. For each of the three exams, the number of questions will remain the same.

Exam Content Outline Changes on Series 63, 65, and 66 Exams

The content outline is not changing for the Series 65 exam. The structure will be very similar for the Series 63 and Series 66 exams.

Content Outline Updates for Series 63 Exam

For the Series 63 exam, Regulation of Broker-Dealers (2) and Regulation of Agents (1) have 3 fewer questions but there are 2 more on Regulation of Securities and Issuers and 1 more on Remedies and Administrative Provisions.

Content Outline Updates for Series 66 Exam

For the Series 66 exam, Economics and Business Information has been increased from 5 to 8 questions. Correspondingly, Investment Vehicle Characteristics has been reduced from 20 to 17 questions.

Score Changes To Series 63, 65, and 66 Exams

The Series 63 and Series 66 will not have any scoring updates. The Series 65 will be updated to require candidates to submit 92 correct answers instead of 94 in order to receive a new passing score of 70%, reduced from 72%.

Content Updates To Series 63, 65, and 66 Exams

There are no changes to the content in the Series 63 exam. The Series 65 and Series 66 exams will have additional material, as well as updates for recent regulatory changes in the Secure Act 2.0. Most of the additions will be identical with two exceptions.

Added to the Series 66 exam is Business Continuation and Succession which, up until now, has been only in the Series 65.

The portion on Investment Vehicle Characteristics for the Series 66 now contains information about many of the topics covered in the Series 65. For example, ADRs and the different types of preferred stock will be tested. Money market instruments and incentive and nonqualified employee stock options are also testable.

Summary of Content Additions to Series 65 and 66 Exams

Predominantly, the additional material reflects changes in the advisory world.

Special purpose acquisition companies (SPACs)/blind pools/blank check companies

Non-liquid REITs

Digital assets (distinction, characteristics, and risks; securities, currencies, and assets)

As part of the client profile, values including environmental, social, and governance (ESG) and religious criteria

Government benefit implications (e.g. income related monthly adjustment amounts)

Donor advised funds

Recommendations meeting a standard of care (essentially, Regulation BI)

Payment for order flow and distinguishing between introducing and clearing broker-dealers

Continuing education requirements for IARs

Exploitation of vulnerable adults

Summary of Content Deletions to Series 65 and 66 Exams

Some examples of what is being deleted from the Series 65 and 66 content are:

viatical/life settlements

investment real estate

dark pools

How Kaplan is Responding to NASAA Exam Changes

Kaplan will release addendums to current Series 65 and 66 material to cover all new content in Student Dashboards under Updates/Corrections by June 1. No addendum will be needed for the changes to the Series 63, as the current study materials have full topic coverage.

On June 12, we will transition our SecuritiesProTM QBank, simulated exams, and practice exams to reflect the new test weights and covered content.

Frequently Asked Questions About NASAA Exam Changes

Below are common questions we receive about how Kaplan responds to NASAA exam changes.

If I take the exam before June 12 and do not pass, will my retake exam include the new material or the material covered on my initial test?

From June 12 on, any exam administered, whether a first attempt or a retake, will follow the new content and structure.

After the changeover, will NASAA make available the questions from the previous question bank?

NASAA, like FINRA, never releases retired questions. Questions on the few areas deleted from the content outlines will no longer be used on securities exams.

How To Ask More Questions About NASAA Exam Changes

If you are a current user of one of our study packages and have any content questions along the way, just send us an email through InstructorLink located on your homepage.

If you are not a current user of one of our study packages contact our support or service teams, by calling 877.731.5061.

Changes in SEC Regulation A and Regulation D

On March 15, 2021 certain important SEC rule changes went into effect.

SEC Regulation A

What is new?

The regulation now provides two offering tiers for both U.S. and Canadian issuers.

Tier 1 securities offerings up to $20 million in a 12-month period, including no more than $6 million sold on behalf of selling shareholders. Subject to a coordinated review by states and the SEC. The issuer must file Form 1-A (greatly simplified from the complex Form S-1) along with two years of financial statements. There is no need for these statements to be audited.

Therefore, on this tier, state “blue sky” laws of every state in which the issuer expects to raise money are applicable. When the offering is complete it must also file an exit report on Form 1-Z not later than 30 days after completing the offering, explaining how much was raised and how the money was allocated. Note that this harmonizes with Regulation D, which also requires a final report (using Form D) within 30 days of concluding the offering. Lastly, there are no restrictions to resale and no investor requirements, such as being an accredited investor.

Tier 2, as of March 15, 2021, securities offerings up to $75 million in a 12- month period, including no more than $22.5 million of securities sold on behalf of selling affiliate shareholders, such as officers and directors. This is an increase from the previous limits of $50 million and $15 million respectively.

Tier 2 permits a kind of mini-IPO allowing small, emerging companies to forego venture capital and raise substantial capital that is subject only to SEC scrutiny, preempting the burden of state regulation. New and innovative companies can look to nonaccredited investors such as their customers, employees, or even the general public for substantive financing with only a fraction of the regulatory burdens formerly seen. As we read in Tier 1, a Form 1-A must be filed along with two years of audited financial statements, and an exit report. A Tier 2 exit report can be satisfied by filing Form 1-Z or alternatively 1-K, which is specifically designed with the view to satisfy both purposes. With this tier the issuer must also file annual (Form 1-K), semi-annual (Form 1-SA), and “current report” (Form 1-U) similar to Form 8-K in public companies.

Companies that are already publicly reporting, such as companies that are listed on an exchange, will be considered compliant concerning their Regulation A ongoing disclosure obligations by remaining current in their public reporting obligations. Non-accredited investors are subject to limits on how much they can buy based on their annual income and net worth unless the offering is to be listed on a national stock exchange, then there is no restriction. Non-accredited investors are subject to investment limits based on the greater of annual income and net worth.

Both tiers exclude blank check companies (SPACS), registered investment companies such as mutual funds and asset-backed securities. “Bad actor” disqualifications also apply. A bad actor includes, in part, the issuer, directors, partners or executive officers who have:

- Criminal convictions relating to securities transactions

- Made false filing with the SEC

- Been suspended or expelled from SROs such as FINRA

These Regulation A offering statements and disclosures must be filed on EDGAR in the same fashion as we previous read about S-1 registrations for IPOs. Tier 2 issuers are required to concurrently file a short-form Form 8-A to register a class of securities under Exchange Act. This is very desirable because it allows a Tier 2 issuer, if it chooses to do so, to list on a national securities exchange. “

Testing the waters” on a new offering under Regulation A is permitted by the issuer to determine investor interest. This is done by distributing statements about the offering right up to the time the SEC qualifies its Form 1-A offering circular. During the pre qualification period, issuers must deliver a preliminary offering circular to prospective buyers at least 48 hours in advance of the sale unless the issuer is subject to, and current in, Tier 2 ongoing reporting obligations.

Regulation D Offerings

What is new?

As of March 15, 2021, a Rule 504, Regulation D offering, which is distinct from most of the Regulation D rules, involves the offering of securities in which the dollar amount does not exceed $10 million. It is distinct from 506 in that:

- There are no limitations on the number of purchasers, accredited or non.

- There is no requirement that purchasers meet suitability or sophistication standards, though bad actors, as mentioned above, are prohibited from participating.

Rule 504 offerings are not available for blank check companies (entities without a defined business or business plan).

| Regulation D | Size | Accredited Investors | Non Accredited Investors | General Solicitation* |

| Rule 504 | $10 million | Unlimited | Unlimited | No |

| Rule 506(b) | Unlimited | Unlimited | 35 | No |

| Rule 506(c)* | Unlimited | Unlimited | 0 | Yes |

*The JOBS Act required the Commission to eliminate the prohibition on using general solicitation under Rule 506 where all purchasers of the securities are accredited, and the issuer takes reasonable steps to verify that the purchasers are in fact accredited.

SEC Regulation Crowdfunding

Issuers may rely upon section 4(a)(6) of the Securities Act of 1933 (Regulation Crowdfunding), which enables companies to offer and sell securities exempt from the registration requirements of the act.

The rules require all transactions under Regulation Crowdfunding to take place online through an SEC-registered intermediary. That may be either a broker-dealer or a funding portal that permits a company to raise a new (2021) maximum aggregate amount of $5 million. The offering requires disclosure of information by filings with the Commission on Form C, including two years of financial statements that are certified, reviewed, or audited, as required. Besides, progress and annual reports. These must also be sent to investors and the intermediary facilitating the offering.

There are now investment limits for accredited investors. For non-accredited investors, they may purchase an amount equal to the annual income, or alternatively, net worth, whichever is greater. Securities purchased in a crowdfunding transaction generally cannot be resold for one year. Regulation Crowdfunding offerings are also subject to "bad actor" disqualification provisions the same as Regulation A and D.

Sample Questions

1) Regulation A, requires an underwriting broker-dealer furnish an offering circular to purchasers?

A. 48 hours in advance of sales

B. 24 hours before the confirmation

C. 72 hours before the confirmation

D. Concurrently with the mailing of the customer confirmation

Regulation A requires that an offering circular be provided to purchasers at least 48 hours in advance of sales, so the answer is A.

2) The maximum public offering permissible under Regulation A is:

A. $500,000 per issuer and $500,000 per affiliate

B. $2 million per issuer and $100,000 per affiliate

C. $2 million per issuer and $500,000 per affiliate

D. $75 million

The maximum size of an offering under Regulation A (sometimes known as A+) is $75 million per issuer, so the answer is D. Sales are measured over a 12-month period.

3) Under Regulation D, Rule 504 offerings provide a safe harbor for the sales of securities:

A. Without regard to dollar amount

B. Not exceeding $10 million

C. Not exceeding $50 million

D. Not exceeding $20 million

Regulation D offerings are exempt transactions under the Act of 1933. Rule 504 provides a safe harbor from full registration for private placements in which the dollar amount to be sold is $10 million or less, so the answer is B. By comparison, Rule 506(b) and (c) has no ceiling on the dollar amount offered.

4) Regulation Crowdfunding permits offering limits to:

A. $500,000

B. $1 million

C. $5 million

D. $20 million

Offering limits are currently set by federal regulators to $5 million, so the answer is C. They also amended the individual investment limits for investors in Regulation Crowdfunding offerings by removing investment limits for accredited investors.

SEC Spells out Use of the Terms “Advisor” and “Adviser” for Dual Registrants

That is about to change for many in the industry.

Many studies indicated that the general investing public was unaware of the differences between a broker-dealer and an investment adviser. Referring to oneself as a financial advisor added to the confusion. Given that the titles adviser and advisor are closely related to the statutory term “investment adviser,” their use by broker-dealers can have the effect of erroneously conveying to investors that they are regulated as investment advisers and have the business model, including the services and fee structures, of an investment adviser. Such potential effect undermines the objective of the capacity disclosure requirement under Regulation Best Interest to enable a retail customer to more easily identify and understand their relationship.

The disclosure requirement of the newly effective (June 30, 2020) Regulation BI attempts to eliminate that issue. In the simplest terms, the term adviser or advisor cannot be used if the member firm’s only registration is that of a broker-dealer and the individual’s registration is only as a registered representative. For those firms (and individuals) who are dual registrants, the term may be used even when the account is only a “BD” account and not solely for

advisory accounts.

The SEC specifically states: “We would presume the use of the terms adviser and advisor by (1) a broker-dealer that is not also registered as an investment adviser or (2) a financial professional that is not also a supervised person of an investment adviser to be a violation of the Disclosure Obligation under Regulation Best Interest.”

As with all rules, there are exceptions, and we recommend you check with legal counsel to see if any of them apply to your personal situation.

General Update for Accredited Investor and Qualified Institutional Buyer

The SEC adopted amendments to the “accredited investor” definition in August 2020. Historically, people who do not meet certain income or net worth tests, regardless of their financial sophistication, were prohibited from investing in many private markets. From here on, individual investors are permitted to participate in private capital markets not only based on income or net worth but also well-defined measures of financial sophistication.

The amendments allow investors to qualify as accredited investors based on professional knowledge, experience, or certifications, in addition to the existing tests for income or net worth. The amendments also expand the list of entities that may qualify as accredited investors, including allowing any entity that meets an investment test to qualify. The SEC also adopted amendments to update and improve the definition of qualified institutional buyer in Rule 144A under the Securities Act of 1933.

The New Categories

- Natural persons qualified based on certain professional certifications, designations or credentials, or other credentials issued by an accredited educational institution

- Holders in good standing of the Series 7, Series 65, and Series 82 licenses as qualifying natural persons. The Commission has the flexibility to reevaluate or add certifications, designations, or credentials in the future

- Concerning investments in a private fund, natural persons who are “knowledgeable employees” of the fund

- LLCs with $5 million in assets

- SEC- and state-registered investment advisers

- Exempt reporting advisers and rural business investment companies (RBICs)

- Governmental bodies

- Funds and entities organized under the laws of foreign countries that own “investments” as defined in Rule 2a51-1(b) under the Investment Company Act, more than $5 million and that was not formed for the specific purpose of investing in

the securities offered;

- "Family offices" with at least $5 million in assets under management; and

- Their “family clients,” as each term is defined under the Investment Advisers Act; and

- The term “spousal equivalent” to the accredited investor definition so that spousal equivalents may pool their finances for the purpose of qualifying as accredited investors

For those who wish to reference the rule, the amendment to Rule 215 replaces the existing definition with a cross-reference to the definition in Rule 501(a).

The definition of qualified institutional buyer in Rule 144A is now expanded to include limited liability companies and RBICs if they meet the $100 million in securities owned and invested threshold in the definition or any institutional investors included in the accredited investor definition provided, if they meet the $100 million threshold.

These amendments become effective 60 days after publication in the Federal Register. Once the new rule is in effect, our question banks will be updated, and the proper text will be added to the Content Updates of most FINRA exams and the NASAA Series 65 and 66 exams.

Sample Questions

Question 1

A registered broker-dealer has lines of business that include acting as an agent for privately placed equity and debt securities. Often the issue amount exceeds $20 million. The firm is medium-sized and currently employs 250 representatives qualified to offer general securities. The firm has a new employee four-month training program with a minimum participation entry qualification requirement of passing the Series 7 examination. This new training class is comprised entirely of people who graduated from college within the past two years and demonstrated an aptitude for the securities industry by taking a third-party administered test. Which of the following statements concerning a new private equity placement is true?

A) Following successful completion of the firm’s training program, a representative’s pay would need to be equal to or exceed $200,000 per year with a strong likelihood that it would continue to be at that level.

B) Following successful completion of the firm’s training program, a representative would qualify to invest in the private offering if able to demonstrate by exam sufficient knowledge of Regulation D and Rule 144.

C) Following successful completion of the firm’s training program, any representative able to prove liquid assets totaling $1 million exclusive of primary residence may make a restricted investment in the offering.

D) Following successful completion of the firm’s training program, each representative would qualify to invest in a private offering.*

Explanation

Participation in a private placement of securities requires, with limited exceptions, that the investor be accredited. That includes those registered representatives who are currently qualified as a Series 7 General Securities Representative.

Question 2

Two Penny Coal, a limited liability company with $500 million invested in investment-grade corporate debt securities was approached by an agent for the issuer of a $1 billion private placement of convertible debentures rated A+ by Standard & Poor’s to judge interest in a $50 million piece. Two Penny Coal investment managers agree to purchase the piece. Which of the following is true following the purchase?

A) The firm may sell the debentures to QIBs without regard to a holding period.*

B) The firm must hold the securities for six months before being offered for sale to any person.

C) The firm may offer to sell the securities to U.S. citizens living abroad without concern of a holding period.

D) The firm must hold the debentures for at least one year.

Explanation

Two Penny Coal is a limited liability company that meets the $100 million threshold of a qualified institutional investor. It may purchase the offered securities and, if it chooses, offer them to another qualified institutional buyer (QIB) without concern of a holding period relying upon Rule 144A.

The SECURE Act: Which Investors Are Affected and How?

It has been several decades since the last major piece of retirement legislation made its way to the President’s desk. With the president’s signature on December 20, 2019, the Setting Every Community up for Retirement Enhancement (SECURE) Act makes many small improvements to existing retirement savings options that, collectively, add up to a significant change. Additionally, the act contains a few provisions not tied to retirement planning, but of interest to financial advisers and their customers.

The act originally passed out of the House in May on a 417-3 vote. It was expected to sail through the Senate and make its way to the President’s desk quickly. A few senators wanted a provision or two added to the bill and blocked passage. After some negotiation, the act passed through the Senate as part of a spending bill and was signed into law.

The SECURE Act brings change to a number of investors, including:

- Those saving for retirement

- Those nearing or in retirement

- Employers with or considering retirement plans for their workforce

- Expectant parents

- Those saving or paying for education

- And several other minor provisions

Saving for Retirement

- Current law prohibits contributions to traditional Individual Retirement Accounts (IRAs) after the age of 70 ½. Beginning with the tax year 2020, this rule is removed. As long as a person has earned income, they may continue to contribute to a traditional IRA.

- Employers who provide a 401k plan for their employees are required to include employees that are age 21 and have worked 1,000 hours or more in the prior 12 months. Beginning in 2021, employers must also include part-time workers. A part-time worker is defined as having worked 500 hours or more for three consecutive years and 21 years old by the end of the three-year period.

- New provisions will make it easier for employers to offer annuities within 401k plans. It is likely that more annuities will be made available within 401k plans as pay-out options for retirees.

Nearing or in Retirement

- Beginning for the tax year 2020, IRA owners must begin to take Required Minimum Distributions (RMD) from their IRAs beginning at age 72. The current requirement is to begin to take these distributions beginning at age 70 ½. This rule does not apply to those that have already reached 70 ½ by the end of 2019.

- Those who inherit an IRA have been able to choose an RMD payout based on their life expectancy. With a younger person, this could result in very small RMDs and accounts that payout for very long periods of time. This is popularly known as a “stretch IRA” and was a popular estate planning tool. However, this rule is changing. For IRA owners who die after the end of 2019, their beneficiaries must take their distributions over a period of 10 years, effectively eliminating the stretch IRA option. If a stretch IRA is part of your clients’ estate plans, it is time to find a new strategy.

Employers

- Small companies (and their employees) have struggled to afford retirement plans for their employees. New rules under the SECURE Act allow the creation of Multiple (or Pooled) Employer Plans (MEPs). Two or more separate employers may join together to offer a retirement plan to their employees. These MEPs may be formed starting on January 1, 2021.

- The Act increases the company tax credit for starting a retirement plan and allows the credit in each of the first three years of the plan.

- Part-time employees may now be included in plans, and there are new rules for offering annuities in employer-sponsored plans.

- Qualified automatic contribution arrangements may be increased over time to as high as 15 percent (the current cap is 10 percent).

- There are several other new rules for employers. Most of these changes are designed to enhance retirement savings. If you are an employer, then you should talk to your plan adviser about changes that affect your company. If you are an adviser, then you should be ready for those phone calls.

Expectant Parents

- The SECURE Act allows for a tax-free withdrawal from IRAs and other retirement plans for the birth of a child without the distribution being subject to a 10 percent penalty. The withdrawal may be up to $5,000, and married couples may each take out $5,000. The distribution must be taken within the first year of the child’s birthday. Income taxes are still due on the distribution but without a penalty.

- The Act extends the same penalty-free withdrawal for costs associated with adopting a child.

Education Savings

- The definition of “qualified education expenses” now includes fees, books, supplies, and equipment needed for apprenticeship programs and certifications.

- Up to $10,000 of 529 funds may be used to pay down student loans for the account beneficiary, plus an additional $10,000 for each of the beneficiary's siblings.

There are other provisions to the SECURE Act, but the above are the parts that are most likely to appear on industry qualifying exams. If you are taking an exam after January 1, 2020, be sure to review when these different rules become effective. You can expect test questions for the new rules to appear along with their effective dates. If you are an adviser, then you should get up to speed on the SECURE Act and the changes it brings to your clients and customers.

New York Amends Regulation 187: What It Means for Insurance

In July 2019, the New York Department of Financial Services (DFS) announced an amendment to New York Insurance Regulation 187 that affects annuities and life insurance sales. It requires insurers to establish new standards and procedures for how agents and brokers make insurance and annuity product recommendations. In this article, I’ll explain the amendment, what it means for insurers and producers, and where you can get more education on this regulatory change.

Looking for Continuing Education classes that meet the Regulation 187 training requirements? We have them in our New York Total Access CE library.

The Best Interest Rule

The “Best Interest Rule” is an amendment to existing New York State suitability standards for annuity transactions. Prior to this change, annuity recommendations producers had to be suitable for the client. The amendment raises the bar in that it requires recommendations to be in the best interests of the consumer. These requirements also apply to life insurance recommendations.Since the DOL Fiduciary Rule was vacated, regulatory bodies and states have been seeking other ways to hold insurance producers, brokers, and financial companies to the same standards.

Amending Regulation 187 is New York’s answer to the issue. The New York DFS official announcement states that the rule “requires insurers to establish standards and procedures to supervise recommendations by agents and brokers to consumers with respect to life insurance policies and annuity contracts issued in New York State so that any transaction with respect to those policies is in the best interest of the consumer and appropriately addresses the insurance needs and financial objectives of the consumer at the time of the transaction.” On August 1, 2019, the best interests rule went into effect for annuities; for insurance, the effective date is February 1, 2020.

What the Rule Means for Insurers and Producers

By mandating that life insurance or annuity recommendations to be based on the best interests of the communities, the rule is designed to keep financial compensation or incentives from influencing the recommendation made to a client. It requires insurers to develop, maintain, and manage procedures for preventing consumer financial exploitation. Basically, insurers must educate and supervise agents and brokers to make sure that they are putting their clients’ needs above their own when they recommend life insurance and annuities products. Also, insurers should take note of the “life insurance policies and annuity contracts issued in New York State” language because it means that non-resident, as well as resident producers, are affected.

There are important exemptions, however. The rule does not apply to retirement plans covered by the Employee Retirement Income Security Act (ERISA), other retirement and deferred compensation plans maintained by employers, and direct sales to consumers where no recommendation has been made by the insurer.

There is controversy around the amendment. The New York Chapter of the National Association of Insurance and Financial Advisors filed a lawsuit to stop it, claiming that exempting direct sales to consumers gives those insurers a competitive advantage over producers. Another lawsuit has been filed by several independent agents’ organizations stating that the amendment is too subjective in the use of the term “best interest.”

If Regulation 187 clears these hurdles, it is very likely that other states and organizations will follow suit. In fact, the SEC has already adopted a package of best-interest rules and regulations. The National Association of Insurance Commissioners (NAIC) is drafting a model regulation that has standards similar to those of Regulation 187. And, New Jersey and Nevada are exploring best-interest rules of their own.

Educate Yourself

The Life Insurance suitability and best interests requirements went into effect February 1, 2020. Producers recommending a life insurance policy to a New York consumer going forward must be trained on the new provisions in Regulation 187 related to life insurance suitability and best interests.

As part of our New York Total Access CE library, Kaplan Financial Education offers several courses designed to help you meet the Regulation 187 training requirements.

FINRA Moves to Prometric as Single Vendor for Securities Qualification Exams

As of January 1, 2018, the Financial Industry Regulatory Authority (FINRA) has chosen Prometric as the single vendor to deliver its many securities qualification examinations (learn which exams Kaplan can prepare you for here).

Historically, FINRA has provided two vendors: Pearson VUE and Prometric. The last day anyone was allowed to sit for a FINRA exam at a Pearson VUE testing center was December 31, 2017.

If a candidate did not pass an exam at a Pearson VUE testing center by December 31, 2017, they are only allowed to reschedule with a Prometric testing center.

Thinking about a career in securities? Download our free eBook, Launching Your Securities Career, to get tips and advice from 100+ securities professionals.

Prometric complies with the Americans with Disabilities Act (ADA) by supporting testing accommodations or modifications. However, the candidate must submit an accommodation request to FINRA for review and approval. If FINRA approves the accommodation, it will then let Prometric know before the appointment.

Those securities professionals who have previously taken examinations at Pearson VUE need not worry about their testing records, as they are maintained by FINRA. If a copy of a score report for a test taken at Pearson VUE is needed, contact FINRA at (800) 999-6647.

FINRA Proposes Big Changes to Securities Continuing Education

New Rules Proposed for both Firm Element and Reg Element CE

Nothing is certain but change! Securities Industry Continuing Education (CE) programs may soon undergo significant changes if new proposals are adopted. The new ideas are now in the “testing the waters” stage and have been floated out to firms at the 2018 FINRA Conference and via new FINRA press-release and Reg. Notice. “What does this mean to me?” you ask. If you’re involved in CE program oversight, compliance, or simply a “covered person” required to complete CE, you should to read on and learn more. Change can be disruptive but may also come with some benefits for you and your firm.

CE Definitions and Historical Context

Firm Element CE (FE) is training delivered to the firm’s “covered persons” (primarily those who meet with the investing public or their direct supervisors). Firm element courses/content—“in house” or via third-party education providers—are determined after conducting a "needs analysis" that is specific to each firm and addresses the nature of business conducted and any pertinent issues affecting the firm or its registrants. The FE needs analysis must also consider the results of its registrants’ recent Reg Element CE completions (i.e., where were they deficient?). Once the needs analysis is done, a firm "training plan" is created. FE is done annually and firms must document, and be prepared to defend, their FE training program.

Regulatory Element CE (Reg Element) is prescriptive training (i.e., determined by FINRA and NOT by the frim) and is based upon individuals’ registration type (e.g., different content for Supervisors vs RRs):

- S101: General Program for Series 7 Registered Persons

- S106: Investment Company Products/Variable Contracts Representatives

- S201: Registered Principals and Supervisors

- S901: Operations Professionals

Reg Element training cycles (registrant’s exam window opens) begin at the second-year anniversary from initial registration and every three years thereafter. Reg Element is delivered online via FINRA’s Online CE System, and curriculum generally consists of important rules and regs, compliance, ethical and supervisory subjects, and sales practice standards. Reg Element must also be completed within prescribed time-frames.

Abbreviated History of Securities Industry Continuing Education (CE)

In concert with the self-regulatory organizations (SROs*), the rules for continuing education were developed by The Securities Industry/Regulatory Council on Continuing Education—or more simply the “CE Council” (CEC)—and approved by the Securities and Exchange Commission (SEC) on February 8, 1995. Firm Element and Regulatory Element (Reg Element) went into effect in July of 1995. Several key Reg Element rule changes were implemented over the years, yet Firm Element (FE) has remained largely untouched.

In 2015, with approval of amendments to FINRA Rule 1250 (Continuing Education Requirements), the “new era” for CE began. Specifically, the CE Online Program was rolled out. As a result, online Reg Element CE fees were reduced to $55 per participant, compared to the physical (onsite) test center delivery charge of $100. Another important change was the elimination of “In-Firm Delivery” of the Reg Element. In-Firm Delivery (via supervised sites set up at firms) was phased out effective January 4, 2016. All Reg Element Programs are now available and must be completed through FINRA's CE Online System.FINRA’s new system allows participants to “satisfy their CE Regulatory Element requirement from a home or office computer—anytime, anywhere.”

The New FINRA/CEC Proposals for Reg Element and Firm Element

If implemented, the new (Sept 2018) FINRA/CEC proposals will have wide impact on firms and their “covered persons”—those who must participate in both Reg Element and Firm Element CE. The new proposals are outlined in FINRA’s Sept 6, 2018 News Release and in more detail through FINRA’s Sept 8 Reg Notice 18-26.

What are the primary “CE Program” changes under consideration? FINRA and CEC are now soliciting feedback from member firms around the notion that Firm Element (FE) can more effectively be provided through a single platform, where content standards are more uniform, redundancies can be minimized, and delivery methodology can be more efficiently tracked and maintained. Specifically, FINRA/CEC are suggesting that all FE content should be delivered via FINRA's Online CE System and supported via email notifications through the Financial Professional Gateway (FINPRO). If these changes are implemented, this would remove both ‘in house’ (member firms) and third-party CE vendors from the CE delivery and in some instances 'tracking' business, albeit FINRA is making it clear that they will continue to 'consider' (presumably there will be a vetting process) and utilize course content from firms and education providers, as long has the content can be formatted for delivery through FINRA’s system. Moreover, FINRA has proposed one (1) course catalogue where all member firms can choose content which meets/matches their training plan along with FINRA’s new “to be defined” minimum standards; “FINRA and the CE Council would work together with third-party training providers to offer a large catalog of readily available materials that are centrally located for convenience.”

FINRA and CEC are also touting the Financial Professional Gateway (FINPRO) e-notification and reporting capability; “The FINRA CE delivery platform provides the most efficient and effective means of tracking their compliance with the proposed CE requirements.”

FINRA/CEC arguments in favor of the proposed ‘FE move’ to FINRA Online CE System:

- Greater consistency in content and presenting material in an optimal learning format.

- Reduction in redundant content (i.e., not repeating topics covered during Reg Element or other credentialing programs); “The CE Council is considering creating a centralized content catalog to serve as an additional source of Firm Element content.”

- Automated email notifications to “covered” registered persons and course completion reporting to firms and individual registrants; “FINRA has also released a system to improve access to data and delivery of services to registered representatives, although the system is not yet widely used. This system, the Financial Professional Gateway (FINPRO).”

- Ensuring adequate CE training is delivered (they are considering“defined minimum standards”)—FINRA has observed that FE training plans vary widely (firm-by-firm), and some firms ‘over train,’ yet other firms “provide very limited amounts of Firm Element, and the CE Council is concerned that registered representatives at those firms may not be receiving adequate training."

- Ability to offer “FE credit” to forms of training not recognized in Firm Element programs today (e.g., offering FE credit to those who recently completed industry credentialing programs—CFP®, CFA®, etc.).

- Assisting those who’ve left the industry—more than 2 years out—by allowing them to reenter (“re-qualify”) by way of completing a TBD curriculum (consisting of both FE and Reg Element content), without having to take a new qualification exam. FINRA is making the argument that this re-qualification process is problematic unless uniformity and consistency are maintained (which can be accomplished via FINRA’s Online CE Program); “The central idea is to allow previously registered individuals to complete an annual Regulatory Element as well as additional content equivalent to Firm Element while out of the securities industry.” However…“Without establishing an industry Firm Element baseline expectation, it is difficult to determine the appropriate expectation for individuals who are maintaining their qualification outside the industry.”

While most of the bullet points above pertain to FE, there is one new notion affecting Reg Element. SICE/FINRA are proposing a move to annual Reg Element CE training versus the current 3-year cycle, and this makes elimination of redundant FE content all the more important from FINRA’s perspective, and no doubt an idea that firms and covered persons will also appreciate.

Timeframe

New regulations are rarely instantaneous and CE rule changes will be no exception. The CE Council is presently gathering additional info on current firm practices and needs. FINRA and the CEC are also soliciting feedback (comment period expired Nov. 8, 2018) and will continue to formulate their ideas before delivery of a formal rule proposal. Given that late time of year (Oct. 2018 as of this article’s publication date) it is unlikely any formal rule will be drafted before year-end. It is more probable that CEC and FINRA will have a new proposal coming in the first or second quarter of 2019 followed by a comment period. Bottomline -- new CE rules will likely NOT be finalized until 2020 or 2021. Yet as the saying goes, "time flies."

Footnotes:

*In May 1993, six SROs—the New York Stock Exchange, American Stock Exchange, Chicago Board Options Exchange, Municipal Securities Rulemaking Board, NASD, and Philadelphia Stock Exchange—created the Securities Industry Task Force on Continuing Education to study the issue of continuing education and to develop recommendations.

MSRB Modifies the Series 52 Qualification Exam

The Municipal Securities Rulemaking Board (MSRB) filed a proposal with the SEC to modify the Series 52 exam into a specialized knowledge examination, while at the same time recognizing a passing score on FINRA’s Securities Industry Essentials (SIE) Examination as a prerequisite. This change was implemented on October 1, 2018.

Summary: General Knowledge Content Redundancy Removed

The Series 52 exam once had general knowledge content that is now tested by the SIE exam. The MSRB accepts FINRA’s new SIE exam and has restructured the Series 52 exam to eliminate duplicate testing of general securities knowledge. The exam is now a more tailored, specialized knowledge exam.

MSRB, Series 6, and Series 7

The MSRB continues to recognize, even revised, the General Securities Representative Qualification Examination (Series 7) for qualification as a “municipal securities sales limited representative,” and the Investment Company and Variable Contracts Products Representative Examination (Series 6) for qualification as an “investment company/variable contracts limited representative to further regulatory consistency.”

There is no impact to the Series 53 exam.

Why the DOL Decision Reversal Doesn’t Matter

In early July, the Department of Justice petitioned the Supreme Court to challenge the US Court of Appeals for the 5th Circuit Court’s decision to vacate the Department of Labor’s long anticipated “fiduciary responsibility”

rule. This decision effectively turned back the clock 2 1/2 years and unwound years of work by the DOL to regulate, restrict, and direct financial advisors to act in clients’ best interest when managing qualified retirement accounts. While

many firms are now breathing a sigh of relief, the reversal of this decision will have no material impact on the direction of the industry. Acting in clients’ best interest, whether it’s qualified or unqualified accounts, is well

underway.

Underperformance

For years now, DALBAR has tracked and reported consistent investor underperformance based on fixed and equity market indexes. In its more recent “Quantitative Analysis of Investor Behavior” published in April, equity investors underperformed the S&P Index by 191 basis points over the last 20 years. While that gap is significant, it pales in comparison to the 416-basis point gap that fixed investors underperformed the Barclays Aggregate Bond Index over the same time period. For 24 years in a row now, both equity and fixed income investors have consistently lagged behind their respective market index by significant margins. The only explanation is bad investor behavior: buying and selling their investments at the wrong time.

Investors haven’t achieved this consistent level of underperformance all on their own. For decades, financial advisors and financial services firms have sold consumers what is emotionally easiest for them to buy. How can I make that claim? When is it easiest to sell an equity? When the market is rising. When is it easiest to sell a fixed asset? When the market is tanking. It’s not the asset class that creates the problem. It’s the use of the asset class that creates the issue of underperformance. Consumers are waking up to the fact that while their financial advisor may be winning, they’re losing.

Managing Emotions: The Triple Win

I entered the industry as a new financial advisor in 1985. Back then, financial planning was the new cutting-edge tool in the industry. Planning helped clients be better investors because they now had longer term goals with defined timeframes. There was incentive for them to save more money if they weren’t on track for their goals. The net result was that clients saved and invested more, and as a result, advisors made more commissions, and their firm had more assets to manage. This was the “triple win.”

Since then we’ve realized that many of the fundamental tools of financial planning, while necessary, are no longer sufficient. Why? Because investors aren’t rational. They act on emotion too often and when they do, it contributes mightily to their underperformance. Tools like Modern Portfolio Theory, asset allocation, and Monte Carlo simulation don’t account for investors getting emotional about their money.

Behavioral finance helps us understand why that happens; between our emotional reflexivity and psychological decision-making-pitfalls, we have a tendency to make poor choices often. Industry-leading financial advisors in the US, Canada, and around the world are now equipping themselves with the tools and skills to recognize and manage client emotions. These new tools, when used effectively, enable clients to make better investment decisions and create an even more powerful value proposition for the advisor. By acting rationally, clients improve their return on their assets, and they end up with more assets. Advisors and their firms who use the powerful tools for behavioral financial advice exercise their fiduciary responsibility by acting in their clients’ best interest. In the end, they have more money to manage and therefore generate more revenue.

Disclaimer: Chuck Wachendorfer is Partner and President of think2perform, Kaplan’s partner for our behavioral financial advice program. The opinions expressed in this article are solely those of the author based on personal research and observations. They should not be viewed as legal advice.

POINT OF VIEW: SEC’s Best-Interest Rule Rises on the Bones of the DOL’s Fiduciary Rule

Disclaimer: William R. James is a Senior Editor at Kaplan Financial Education. The opinions expressed in this article are solely those of the author based on personal research and observations. They should not be viewed as legal advice.

Following a loss of two federal appeals court hearings and the passing of a deadline to seek a Supreme Court review, it is safe to say that the Department of Labor’s Fiduciary Rule is dead. The objective of the rule was to ensure that financial professionals (broker-dealers and registered representatives) put their customers’ financial interests ahead of their own when recommending retirement investments. President Trump ordered a review of the rule “to determine whether it may adversely affect the ability of Americans to gain access to retirement information and financial advice.”

So where does that leave us? After laying out $5 billion to implement the DOL’s regulatory thrust, there’s much bewildered head-scratching in the financial services industry. What was that all about? In some ways, there’s a sense of relief that regulation is settling back to its customary regulatory provider by registered advisers and broker-dealers. But, Congress’s view of two separate authorities acting in different capacities was tamped down, leaving the whole matter in a legal mess.

The DOL Stumbled

Congress looked explicitly to the DOL for regulatory protections of retirement plans rather than the SEC, reasoning that the Commission operates under a different regulatory framework and that it has no jurisdiction over advice appertaining to an investment that is not a security. In other words, special protections would be desirable for retirement accounts and that, in the view of Congress, would be best handled by the DOL. The Fifth Circuit was mindful of that. But it then found that the DOL did not have the authority to adopt the new fiduciary advice definition (“the Fiduciary Rule…is inconsistent with the entirety of ERISA’s ‘fiduciary’ definition”) and, that by adopting the Fiduciary Rule, it acted arbitrarily and capriciously (“the Rule fails to pass the tests of reasonableness as viewed under the Administrative Procedures Act”). The court vacated the Fiduciary Rule in toto, striking down both its new fiduciary advice definition and the exemptions from it.

What drove the DOL to turn its back on a wealth of available expertise is inexplicable. The SEC has decades of experience dealing with disclosure, and yet the DOL sought no counsel or advice. In fact, that reach was slapped by the Fifth Circuit, which called out the DOL’s highly questionable authority and vacated its controversial, checked-out rule. The Fifth and Tenth Circuits found it wanting, ordering the DOL to vacate the rule, declaring it unreasonable. It constituted "an arbitrary and capricious exercise of administrative power.” The Department of Labor’s overstepping to transform and regulate in entirely new ways many thousands of financial services providers and insurance companies for retirement plans, falls outside of what is reasonable.

Enter the SEC

Stepping up quickly to fill the void, the SEC announced its own long-anticipated alternate rule. Known as Regulation Best Interest (Reg BI), the Commission took a decidedly different approach. SEC Chairman Clayton voiced the concern of many that there needs to be “clarity and harmony to investment advisor, broker-dealer standards of conduct.” SEC Commissioner Michael Piwowar, who along with Clayton voted in favor of the Best Interest proposal, stated, “A solid building block, it imposes a new best-interest standard.”

Despite Congress’s intentions, Reg BI is the Commission’s answer to the Labor Department’s now defunct rule with the aim of providing a unified fiduciary standard. Commissioner Piwowar has made his distaste for the DOL’s effort obvious. He described it as a “terrible, horrible, no good, very bad” rule due in part to the DOL acting unilaterally without any input from the SEC, FINRA, state securities, and insurance regulators.

The SEC-proposed rule appears to offer a gentler approach than the DOL. By introducing a uniform standard of conduct for broker-dealers and registered advisers in light of their different relationship types and models for providing advice, the Commission offers a deft touch to regulation. Brokers would be required to disclose conflicts of interest and look to eliminate or “mitigate” them. But, brokerages would be required to mitigate every material conflict of interest. That means the door is open for a carefully applied sales contest. The SEC has stated: “We do not intend our standard to prohibit a broker-dealer from having conflicts when making a recommendation."

With this shift, financial services firms are now free to review their policies as they pertain to retirement accounts. Even with the departure of the Fiduciary Rule, firms want to keep clients’ best interests in the forefront and consistent with just and equitable principles of trade.

The Defunct Fiduciary Rule vs. the Proposed Best-Interest Rule

So, how do the rules differ? Here are some of the main differences.

Form CRS

In the view of some commissioners, one of the failings of the DOL rule was that it dismissed the SEC’s experience dealing with conflict of interest disclosure. In this requirement, the SEC is addressing the confusion from the use of misleading titles by financial services professionals. Retail investors must be able to distinguish between the types of financial service providers they can choose. This may include those member firms and associated persons who sell products and those who offer advice as a fiduciary.

Currently, the many impressive sounding titles used by financial services professionals offer investors little help. For example, under current regulations, anyone can use financial “adviser” or “advisor,” regardless of whether they are registered investment advisers complying with investor protections or not.

The SEC’s new Form CRS will require financial services professionals to provide their retail customers a simple disclosure form to clarify the scope of customers’ relationships with those who offer them financial services.

Regulation Best Interest (Reg BI)

In looking for a regulatory alternative to the DOL Fiduciary Rule, the Commission is seeking to ultimately adopt a clear rule for which compliance is not so difficult that firms stop offering retail investors services they can pay for through commissions or other transaction-based fees. This is in stark contrast to the DOL rule. The “best interest” standard is altogether different from the long-established Investment Adviser’s Act fiduciary standard and FINRA’s suitability standard. The ambiguity in the SEC’s proposed rule may likely make it difficult for broker-dealers to know how to comply with it, which could then lead to a decision to stop offering transaction-based services.

The question must be considered, will Reg BI raise compliance costs to such a level that it becomes disadvantageous for broker-dealers to offer retail investors transaction-based advice?

The SEC’s proposed rule will require:

- Broker-dealers and registered representatives to not place their interests ahead of those of their retail customers

- Protection of retail customers from investment strategies that drive up broker-dealer fees

- Broker-dealers to provide customers with enhanced disclosures of conflicts of interest.

Interpretation of the Standard of Conduct for Investment Advisers

The issue hasn’t received the same hard look as the broker-dealer standard of conduct. Most would be able to identify the “fiduciary duty” as the standard of conduct for investment advisers, but readily identifiable parameters may not be so easy to find. In other words, what precisely does the fiduciary duty demand? The Investment Advisers Act offers few particular obligations related to the standard. Consequently, the proposed interpretation places its requirements from common law principles.

The DOL’s heavy legal hand will not be missed. The specter of class-action lawsuits no matter how watered down by exemptions or looming private right of action had a chilling effect, causing the abandonment of entire lines of business, in addition to the $5 billion price tag before it was vacated.

The Commission’s best-interest rule drubbed out the legal axe that hung over the necks of broker-dealers and their associates who failed to pick up the nuances of the DOL’s Fiduciary Rule. The DOL provided a path for customers to sue brokers in class-action lawsuits. The SEC-proposed rule has no such blade in it. This suggests to careful readers that FINRA’s Code of Arbitration will remain the backbone of dispute resolution.

More Choice

The legality of the SEC stepping up to plug the hole left by the DOL’s Fiduciary Rule being vacated has yet to be decided. The current congress has not made any appreciable noise about it. In that absence, it is safe to say that the SEC’s take is correct. Apart from the plain language approach, which is a welcome break, providing customers more choice is a good thing. The Commission sent a clear message to the financial services industry: inform clients of and eliminate or greatly diminish (not eliminate) conflicts. Informed choice is the underlying principle over the ponderous and legal morass facing those firms that did not toe the line with the Labor Department’s rule.

Amendments to the CUSIP Rule (MSRB Rule G-34) Effective June 14, 2018

Background

In trading, receiving, delivering, and safekeeping municipal debt securities, it is far easier for dealers to identify a specific bond if it has a CUSIP number assigned to it.1 There are millions of municipal bonds issued, and they can be very similar. For example, an Ohio Turnpike, 4.000%, maturing in October 2028 Series 67760HHE4 can easily be mistaken for an Ohio Turnpike, 4.000%, maturing in October 2028 Series 67760HHF4.

New Requirement

The Municipal Securities Rulemaking Board (MSRB) amended its Rule G-34, on CUSIP numbers. Among other things, the amendments codify the Board’s longstanding interpretive view that BDs are “underwriters” when acting as placement agents of private placements of municipal debt securities, including direct purchases.2

Also, the amendments place a requirement on non-dealer municipal advisors to obtain a CUSIP number when advising an issuer on a competitive underwriting.

That said, the revised rule provides an exception. When dealers and municipal advisors in competitive sales reasonably believe (e.g., by getting a written statement) that the present intent of a purchaser is to hold the bonds to maturity (or earlier redemption or mandatory tender3), the requirement to obtain a CUSIP number may be waived.

Clarification of the Definition of Underwriter

The amendments will delete the existing definition of “underwriter” and instead cross reference to the term “underwriter” as it is defined in Exchange Act Rule 15c2-12(f)(8)4, thus adding wider and clearer understanding of the term as understood by most municipal securities professionals.

All-Inclusive Application of the CUSIP Number Requirements

The amendments will apply the CUSIP number requirements to all municipal advisors advising on a competitive sale of a new issue of municipal securities rather than just some of them. The Board is now of the view that requiring some municipal advisors to obtain CUSIP numbers in competitive sales creates problems.