Securities Career Articles

What Is the Best SIE Exam Prep for You?

- The best SIE exam prep depends on your learning style, budget, schedule, and target exam date.

- There are different types of SIE prep to choose from, including live online courses, on-demand courses, and self-studying options.

- The best free SIE prep offers realistic practice and can help establish a baseline for your studies and/or supplement your course.

Ultimately which type of SIE exam prep is right for you will depend on a few key details. Just like you are researching which employers you want to work for, you’ll need to spend some time figuring out the best way for you to prepare for the SIE exam.

Kaplan Financial experts recommend spending 4 to 6 weeks preparing for the SIE exam so it’s important you be honest about your schedule and learning style. Recent SIE exam pass rates demonstrate the need for investing in quality SIE exam prep. In this guide, we’ll review SIE prep options so you can choose the best SIE exam prep for you.

Factors to Consider When Choosing the Best SIE Prep

There are a few questions to answer that will help you determine the best SIE prep for you. Start off by answering these questions:

- When would you like to take the SIE exam?

- How long do you plan to study for the SIE exam?

- How much time do you have to study per week?

- What is your preferred learning style?

- Do you have a budget for SIE exam prep?

Once you’ve answered these questions, you can narrow down your options. Fortunately, there are many ways to study for the SIE exam so let’s get started evaluating your options.

What Type of SIE Prep Course Is Best for You?

If you're thinking about enrolling into a SIE prep course, use your answers about learning style, budget, and schedule to guide your decision. Consider these questions to further narrow down your search for the best SIE prep course:

- Do you prefer to prepare alone or with a teacher? Your answer to this question will determine whether you should take a live online SIE prep course or if you should consider a self-paced, on-demand course and/or other SIE study materials.

- Do you prefer to use a study package or piece together a study package with individual study tools? Your answer to this question will determine whether you should purchase a study package or purchase a course with individual study tools.

- Do you prefer live, scheduled classes or do you want the flexibility of an on-demand course? Your answer to this question will determine if you can commit to a scheduled class or if a more flexible on-demand option would be better for your schedule.

Best SIE Prep Courses

While self-studying is an option, taking an SIE prep course can provide valuable structure, guidance, and resources that can significantly increase your chances of success on the exam. Whether you prefer live online instruction or flexible on-demand options, we’ll help you find the best SIE course to maximize your performance on the exam and get you one step closer to becoming a securities industry professional.

- Live Online Course: Best SIE prep course for Interactive Learners

- On-Demand Course: Best SIE prep course for Self-Directed Learners

Kaplan Financial SIE prep packages have been consistently ranked by third parties* as a great SIE prep provider due to our affordability, tailored study plans, engaging video lessons, and personalization. But don’t just take our word for it, hear what education experts have to say about what makes Kaplan SIE prep packages stand out from the competition:

Test Prep Insight chooses Kaplan Financial vs. Pass Perfect as the “Editor’s Choice”*: “First up, it’s important to note that the prep bundles from Kaplan are more affordable than those from Pass Perfect.”

Test Prep Insight also chooses Kaplan Financial vs. ExamFX as the “Editor’s Choice”*: “Unlike many other exam prep companies, such as ExamFX, Kaplan stands out by offering live classes, giving students a more personalized and guided learning experience. These live sessions are perfect for those who benefit from structure and enjoy the accountability of a scheduled class."

*Source: https://testprepinsight.com/comparisons/pass-perfect-vs-kaplan/ and https://testprepinsight.com/comparisons/examfx-vs-kaplan/. Test Prep Insight is a review and analytics site that is a Kaplan affiliate but uses an independent review process to evaluate exam prep products.

Live Online SIE Classes

The benefits of using a live online SIE course is having that traditional structured learning environment you’re probably most used to. They include access to expert instructors who can guide you through challenging concepts and high-yield exam topics. They are the most interactive and allow you to ask questions in real-time, join discussions, and receive personalized feedback from your instructors.

Live online SIE courses often include comprehensive resources and support, including practice tests, video lessons, and study plans. Plus, you’ll have the opportunity to connect with classmates and form study groups, helping you to stay motivated throughout your SIE exam prep.

Live Online SIE Course Benefits:

- Interactive sessions led by an expert instructor

- Study from home (fully digital)

- Comprehensive resources and support

- Connect with classmates

Investopedia chooses Kaplan Financial’s Live Online SIE Course as “Best for live teaching.”†

OnDemand SIE Classes

Candidates who won’t have a flexible schedule may prefer an on-demand SIE course. On-demand courses are the most flexible and convenient for busy candidates who can’t commit to a set schedule every week and like to study at their own pace.

On-demand courses typically offer pre-recorded video lectures, practice questions, and other resources that you can access anytime. This allows you to review material at your own pace and focus on the areas where you need the most help.

Additionally, some on-demand courses include live office hours or online forums where you can connect with instructors and other candidates for additional support and guidance. If you are a self-motivated learner who values flexibility and convenience, an on-demand SIE course may be the best option for you.

SIE On Demand Course Benefits:

Source: Investopedia. Best SIE Exam Prep Courses for February 2025: https://www.investopedia.com/the-best-sie-exam-prep-courses-11688253. Investopedia is a review and analytics site that is a Kaplan affiliate but uses an independent review process to evaluate exam prep products.

- Flexible schedule

- Go at your own pace

- Some live online options may be available

- Study from home (fully digital)

Self-Study SIE Prep Package

A self-study SIE package is going to be best for self-directed candidates who have a proven record of success when studying without the guidance of an instructor. Look for packages that allow you to build a customizable study plan based on your study schedule and exam date.

Don’t forget to make sure the package includes reading materials that provide comprehensive overviews of exam topics. Also look for self-study packages to include practice questions and quizzes that can be customized to your study progress and current performance.

Compare SIE Study Packages

Best SIE Exam Prep Books

The best SIE exam prep books should contain everything you need to know about the exam and come with complimentary notes to help you organize your lessons and highlight important exam topic information.

SIE License Exam Manual (LEM)

This comprehensive textbook is one of the best SIE exam prep books available to candidates. It contains everything you need to know for the exam, broken down into easily digestible units. Kaplan Financial’s team of experts built the content with a focus on the latest rules and regulations. Each section contains key topics and terms, multiple graphics, exercises, quizzes, and discussion questions to help you learn faster and remember important information as you prepare for your exam.

SIE Prep Class Notes

Having access to some sort of class notes will help you complement your instructor’s lessons. Kaplan Financial's SIE prep class notes are spiral-bound books that highlight important exam topics and include the key points addressed in your classes. These notes, grouped by lesson, allow you to focus on the instructor and give you an organized review after class has ended.

Best SIE Exam Study Tools

Individual SIE study materials can enhance your exam prep whether you’re taking an SIE course or prepping on your own. There are many different SIE study materials available, including books, quicksheets, practice tests, and flashcards. Look for resources that are developed by industry experts and that feature realistic prep so there are no surprises on exam day.

SIE Practice Tests

SIE practice exams should mimic a true exam experience in terms of difficulty, timing, format, and topical coverage. It’s recommended that you take at least one SIE practice exam before sitting for the actual exam. Depending on how you perform on the practice exam, you may want to take an extra practice exam for even more confidence.

The Mastery Exam offered by Kaplan Financial is similar to the Practice Exam provided in study packages and as an individual study tool, except it contains unique questions not seen on your Practice Exam to really help you feel confident on exam day.

SIE Quicksheets

SIE quicksheets are a great way to maximize your study time and refresh your memory. This type of study tool helps you prepare on-the-go with quick reviews of the "must-know" key definitions and concepts on the SIE exam. Another great benefit to using a quicksheet is they give you a way to study critical exam material without having to page through an entire textbook.

SIE Flashcards

SIE flashcards are a classic study tool for a reason. They help you memorize securities terms and formulas and allow you to give yourself a quick quiz anywhere.

SIE Qbanks

SIE practice questions are one of the best ways to reinforce your course or book learnings. When evaluating SIE practice questions, look for ones that are interactive and give you the option to build personalized quizzes based on length and topics of your choice. Even better if they allow you to randomly generate questions which will surely help you feel confident going into exam day.

Try a Sample Audiobook of Kaplan Financial’s SIE License Exam Manual

What’s the Best Free SIE Exam Prep?

Taking advantage of free SIE prep resources is a great way to start your securities exam prep. No matter what type of free SIE prep you use, ensure that the resource comes from a reputable source and uses realistic material. Free SIE prep is a great way to get a baseline to help you figure out what type of prep you should invest in and/or supplement your current SIE course. Below, we list some resources for free SIE prep offered by Kaplan Financial.

- Free SIE Question of the Day: Get a free SIE exam practice question–with detailed answer explanations–delivered to your inbox every day.

- Free SIE eBook: Get a free guide to learn about the exam and how to take advantage of the SIE exam to better position yourself for your big break in the industry.

- Free SIE Study tips: Learn how to overcome common roadblocks and what the latest pass rates are.

*Source: https://testprepinsight.com/comparisons/pass-perfect-vs-kaplan/ and https://testprepinsight.com/comparisons/examfx-vs-kaplan/. Test Prep Insight is a review and analytics site that is a Kaplan affiliate but uses an independent review process to evaluate exam prep products.

†Source: Investopedia. Best SIE Exam Prep Courses for February 2025: https://www.investopedia.com/the-best-sie-exam-prep-courses-11688253. Investopedia is a review and analytics site that is a Kaplan affiliate but uses an independent review process to evaluate exam prep products.

What is the SIE Exam Passing Rate?

If you’re taking the FINRA Securities Industry Essentials (SIE) exam, you might be wondering about the passing rate. And you probably want to know how hard the exam is. Although more than three-quarters of those who sit for the SIE exam end up passing it, it’s still challenging. Let’s take a look at the data and then see what you can do to increase your chances of passing.

SIE Exam Passing Rate

- SIE and Series 6: 80%

- SIE and Series 7: 84%

- SIE and Series 79: 96%

Thinking about taking the SIE exam? Our free Candidate's Complete Guide to the SIE Exam is packed with useful information.

How Hard Is the SIE Exam?

The SIE exam is not easy. You should be prepared for a challenge. You are expected to know about capital markets, securities products, and regulations, as well as how to trade securities and what products are prohibited.

Although the exam requires some math and a few calculations, mostly you are being tested on how well you read the exam questions and your understanding of finance and securities concepts. Knowing definitions will not be enough. You should also be prepared for one word being used to mean different things and, conversely, several different words being used to mean the same thing. For examples and more details, read our article on frequently encountered SIE exam roadblocks.SIE Exam Topics and Weights

The SIE exam consists of 75 multiple-choice questions plus 5 unscored questions, and you have an hour and 45 minutes to complete it. The topics and the number of questions assigned each are:

- Knowledge of Capital Markets: 12 (16% of the exam)

- Understanding Products and their Risks: 33 (44% of the exam)

- Understanding Trading, Customer Accounts, and Prohibited Activities: 23 (31% of the exam)

- Overview of the Regulatory Framework: 7 (9% of the exam)

As you can see, the second and third sections make up 75% of the exam, so you need to do well on both those sections. But don’t overlook the other two. They are important because you will need to know how to apply those concepts in future securities licensing exams.

SIE Exam Study Tips—How to Increase Your Odds of Passing

These tips will help you develop the knowledge and confidence necessary to increase your odds of passing:

- Develop a study plan around your strengths and weaknesses of the exam topics. Use the SIE Exam Content Outline from FINRA as a starting point.

- Develop a study schedule that breaks up 140-180 hours of total study time over the course of 2-3 months for the SIE exam. Make sure to include 60-80 hours of reading time within your study schedule and plan to add even more reading time if you are unfamiliar with the financial services industry.

- Develop a steady, regular study routine. A routine can increase your retention dramatically. Balance your studying between reading and practicing with breaks in between that enable concepts (and how to apply them) to percolate. Relying solely on frantic cramming a few days before the exam is not recommended because you aren’t tested on memorization.

- Be sure you have a thorough understanding of finance and the markets, and are keeping up with trends. Take some extra study time to listen to podcasts or YouTube videos about investing. Subscribe to updates from financial news sources online. Visit online discussions of finance, the stock market, and securities on Quora and Reddit. Build your confidence by answering practice questions and taking practice exams.

- SIE practice questions and exams enable you to assess how well you understand and apply critical concepts. You’ll be able to address weaknesses and become accustomed to the kinds of questions you’ll be asked on the exam.

Ready for the Challenge?

If you’re interested in taking the exam, check out our SIE exam preparation packages. You can also find answers to the most commonly asked questions about the exam in this SIE FAQ.

Securities Industry Essentials (SIE) Exam: Frequently Asked Questions for Businesses

The introduction of FINRA’s Securities Industry Essentials (SIE) exam in October 2018 fundamentally changed the securities licensing process. Today, firms continue to navigate these changes, benefiting from the restructuring while adapting their strategies. We've compiled and answered some of the most common questions we hear from our partner firms.

How Does The SIE Exam Impact Your Firm’s Recruitment Efforts Today?

FINRA's restructuring of securities exams offers many potential benefits, particularly for firms aiming to enhance efficiency in their recruiting and onboarding processes. Your firm currently has several strategic options when bringing on new representatives. You can make passing the SIE exam a condition of employment, require new hires to pass the SIE exam before they take a specialized knowledge exam, or even have new hires take both exams concurrently.

How Does The SIE Exam Affect Your Onboarding Process?

Candidates now must pass multiple exams before they can register with FINRA. This reality can extend the onboarding process, as it requires accounting for exam scheduling, testing, and potential waiting periods for retakes.

How Can Your Firm Strategically Use This Revised Structure to Your Advantage?

Thinking strategically, the SIE exam continues to allow firms to create pipelines of qualified candidates. This can lead to reduced onboarding and recruiting costs, increased speed to production, and the development of more agile and effective workforces.

Can Your Firm Partner With an SIE Exam Prep Education Provider?

Yes. Many training providers offer exam preparation courses and programs specifically designed to assist students with passing both the SIE exam and subsequent qualification exams. Kaplan, for instance, continues to offer online classroom and blended self-study exam prep programs, supporting tens of thousands of successful candidates annually.

These proven approaches are widely used to implement SIE-related programs within numerous universities, many of which Kaplan partners with for CFP® certification education and CFA®-based curricula, as well as with thousands of corporate partners. Our integrated strategy focuses on connecting these universities with potential employers to provide sources of highly qualified candidates, while simultaneously preparing individuals to pass the SIE and qualification exams and supporting their ongoing careers in the securities industry.

Can Firms Use a Candidate’s Passing Of The SIE Exam as a Reliable Predictor Of How They Will Perform On Their Qualification Exams?

While a candidate successfully passing the SIE exam demonstrates mastery of basic industry knowledge and proficiency in handling a high-stakes exam experience, it has become clear over the years that there isn't a direct or simple correlation to how they will perform on their respective qualification exams. While foundational knowledge is essential, the specialized exams require candidates to further apply this knowledge with a deeper, more specific approach.

How To Adapt Your Internal Training Program & Process to Accommodate The SIE Exam

You have several options for onboarding new hires:

- Hire applicants who have already successfully passed the SIE exam.

- Onboard individuals and require them to take the SIE exam prior to their qualification exam.

- Request new hires to take both the SIE and qualification exams together.

Additionally, many of the firms Kaplan partners with on corporate training programs continue to express interest in leveraging the SIE exam for their non-registered administrative employees. A deeper understanding of the industry among all staff contributes to more agile and effective workforces, which remains key to growth and competitive positioning.

What Are The Benefits Of These Changes For Companies Today?

By creating pipelines of candidates who have demonstrated mastery of fundamental securities-related knowledge, firms are able to reduce costs associated with recruiting and licensing. Crucially, firms can mitigate the drain on productivity often experienced when bringing on new hires. Firms that currently have, or plan to develop, relationships with local universities continue to hold an advantage in leveraging the benefits of this exam. As noted, many firms are still interested in having their administrative staff prepare for and sit for the SIE exam as well.

What Are The Challenges Presented By The SIE Exam Today?

One concern that emerged and continues to be addressed is the potential for individuals who have passed the SIE exam to misrepresent their qualifications to investors. In response, FINRA implemented SIE Rules of Conduct requiring individuals to attest that they are not qualified to conduct securities business with the public until they meet the additional requirements of being associated with a firm and passing a specialized knowledge exam.

Additionally, candidates still need to pass multiple exams before registering with FINRA, which can extend the onboarding process to account for exam scheduling, testing, and waiting periods for retakes.

Finally, for those firms who choose to hire individuals without the SIE credential, the total cost in terms of exam fees has grown significantly since 2018, and is expected to sharply increase again soon.

Hopefully this article has helped clear up confusion and answer any questions you have about the SIE Exam's continued impact on your firm. If you're looking for more information, you can access our SIE Information Center. We also continue to offer FAQs for candidates and universities to answer SIE-specific questions.

9 Helpful Tips for Passing the SIE Exam

As you prepare to sit for FINRA’s Securities Industry Essentials (SIE) exam, you may be wondering what the experience will be like on exam day. Oftentimes, candidates get anxious prior to an important exam just from the anticipation of the unknown. But there are things you can do prior to the exam to reasonably control your nerves and put your best foot forward when you sit to take the exam.

It’s important to remember that passing the SIE is possible with hard work and good study habits. If you’ve completed an SIE exam prep program, you’ve already solidified your knowledge. Now take your exam prep across the finish line by applying these nine crucial tips on SIE exam day to ensure you pass the SIE.

Tip #1: Read the Full Question

Confidence is an important tool in your test-taking arsenal. But misplaced confidence can also cause problems when you’re sitting for the SIE exam if you’re not careful. Questions are often written to trap people who assume too much. The question may not be asking what you think it is if you don’t read it in its entirety. Read each question completely before choosing your answer to help ensure you pass the SIE the first time.

SIE Exam Roadblocks and Solutions >>

Tip #2: Watch for Hedge Clauses

A hedge clause is a term like if, not, all, none, or except. In the case of if statements, the question can be answered correctly only by taking the qualifier into account. Be on the lookout for these words, and make sure you fully consider how they affect what’s actually being asked.

Tip #3: Look for Keywords and Phrases

Certain words provide clues to the situation being presented. For example, the word prospectus gives you a clue that the question is about a new issue. Prior to the actual exam, when studying, consider writing down a list of phrases you think may be important on the full test.

Tip #4: Interpret the Unfamiliar Questions

It’s likely that you will come across some questions on the SIE exam that seem unfamiliar at first glance. Don’t let it throw you off. Sometimes questions present information indirectly, making something you’re quite familiar with seem unfamiliar. It can be helpful to interpret the meaning of certain elements before you can answer the question. To thoroughly test your grasp of the knowledge, expect the exam to test concepts from multiple angles.

Try Today’s Featured SIE Exam Practice Question

Tip #5: Use Information from Prior Questions

This is something test takers don’t always think about in the moment. But be attentive to it. Some questions need to provide you with information to set a scene and give you what you need to answer the question being asked. That information may prove valuable, providing clues to an answer on another question later in the exam.

Tip #6: Define What is Being Asked

Questions sometimes provide too much information, and not all of it is relevant. Learn to separate the story from the question to get to the heart of what’s really being asked. This is something you can practice before the exam so you’re prepared for it when you face it.

Planning to sit for the SIE Exam? Download a FREE copy of the Candidate's Complete Guide to the SIE Exam.

Tip #7: Use a Calculator

Most of the questions that require calculations on the SIE exam are written so the math involved is simple in nature and function. But in a potentially high-stress situation, you are more prone to making mistakes. Use a calculator to ensure that common math errors don’t lead to incorrect answers.

Tip #8: Beware of Changing Answers

If you are not completely sure of an answer, you should trust your first hunch. Only change answers when you discover you didn’t read the question correctly, or you find additional helpful information in another question.

Tip #9: Pace Yourself

Keep an eye on the time remaining, which will be displayed on your computer screen. Be aware of the time you have left to complete the exam and the number of questions you have remaining. Don’t panic, but pace yourself appropriately to ensure you’re not scrambling in the end. A common way test takers maintain a pace is answering the questions they know instantly first, and then coming back to the more difficult questions later.

Study For The SIE Exam With Confidence

Kaplan's digital-first SIE exam study packages offer expert instruction and realistic study materials to help you succeed on the exam. Our enhanced SIE course uses an innovative blended learning approach to introduce securities concepts and reinforce exam prep best practices. Each course includes micro-learning videos, questions, resource links, and exam simulation.

Frequently Encountered SIE Exam Roadblocks and Solutions

The Securities Industry Essentials (SIE) examination is designed to assess a candidate’s knowledge of the fundamentals of the securities industry. Its content is focused on products and their risks, the process of raising capital, the structure of securities markets, and the role of various regulatory agencies.

Even though this exam focuses on the basics, there are still challenges candidates need to learn how to overcome to be successful on exam day. Below are some of the most common challenges encountered by candidates preparing for the SIE exam and advice about overcoming them.

SIE Roadblock #1: Taking Practice Tests

We strongly recommend candidates complete the 75-question SIE Practice Test provided by FINRA. Spending the time to review the practice test will pay dividends by exposing SIE exam candidates to a test created by the same writers who author the real exam.

Remember, FINRA exams are written by committee and, unlike other standardized tests such as the SAT, the language and sentence structure may vary between individual questions. Some questions may contain legal jargon contained within various FINRA rules, while others may employ more of a conversational tone. The point of taking FINRA’s SIE Practice Test is to gain exposure to several different writing styles and “spins” on topics before taking your actual test.

SIE Roadblock #2: Specialized Language and Acronyms

The SIE exam is, above all, a reading comprehension exercise. There are very few math computations on the test. Exam writers expect candidates to be comfortable with the specialized language of finance, and common acronyms.

For example, here are some acronyms candidates should learn when preparing for the SIE exam:

- FINRA: Financial Industry Regulatory Authority

- SEC: Securities and Exchange Commission

- NYSE: New York Stock Exchange

- NASDAQ: National Association of Securities Dealers Automated Quotations

- OTC: Over-the-Counter

- IPO: Initial Public Offering

- ETF: Exchange-Traded Fund

- CD: Certificate of Deposit

- IRA: Individual Retirement Account

- 401(k): Retirement Savings Plan

- MSOS: Municipal Securities

To learn more specialized language and commonly used acronyms, candidates are strongly encouraged to review the glossary at the back of the Kaplan License Exam Manual (LEM).

Planning to sit for the SIE Exam? Download a FREE copy of the Candidate's Complete Guide to the SIE Exam.

SIE Roadblock #3: One Word May Have Several Meanings

As you begin preparing for the SIE exam, you’ll notice some words have multiple meanings or can be interpreted differently based on context. Some examples are:

- Principal

- Covered

Understanding the Multiple Meanings of “Principal” on the SIE Exam

When the word principle is used on the SIE exam it could refer to:

- a bond’s face value,

- a person in a managerial position at a brokerage firm, or

- the capacity of a firm on a given trade.

Understanding the Multiple Meanings of "Covered" in Options Trading

Below are three different examples of how the word covered could be used on the SIE exam.

1. Covered as Ownership of Underlying Asset

- Call Writer: Covered by owning a long stock position. (Long position offsets obligation to sell.)

- Put Writer: Covered by a short stock position. (Short position offsets obligation to buy.)

2. Covered as Slang for a Protected or Hedged Position

- Put Option: Covers a long position by locking in a minimum sales price.

- Call Option: Covers a short position by locking in a maximum purchase price.

3. Covered as Closing Out an Options Position

- Closing Sale: Covers (closes out) a buyer's existing open long option position.

- Closing Purchase: Covers (closes out) a writer's existing open short option position.

SIE Roadblock #4: Multiple Terms Used to Reference the Same Concept

Another reading comprehension strategy candidates should practice is applying multiple terms to reference the same concept. Some examples of terms that can be used to reference the same concept are:

- Options writers: These individuals are the ones who write or create the options contract, obligating themselves to fulfill the terms of the contract if the buyer exercises their right.

- Options sellers: This is another term for options writers. They are the ones selling the contract to the buyer.

- Going short a contract and option: This phrase indicates taking a position where profit is made if the price of the underlying asset decreases. In options trading, selling an option is considered a "short" position.

In essence, all three terms describe the party who takes on the obligation in an options contract in exchange for the premium paid by the buyer.

Conversely options owners, options buyers, and going long a contract reference the same ideas. Remember, the SIE exam is written by a committee, and the writers may employ their own favored terminology.

Try Today’s Featured SIE Exam Practice Question

SIE Roadblock #5: Learning SIE Math Formulas

Remember, the SIE exam focuses on reading comprehension. Candidates can expect very few calculations on their exam. Many candidates report only seeing one or two calculation items. Here are the three formulas that are the most likely to be tested on the SIE exam:

- % Sales Charge (load) for a Mutual Fund Purchase = (POP – NAV)/POP

- Current Yield = Annual Interest Payment/Bond Price

- Dividend Yield = Annual Dividend*/Stock Price

SIE Expert Tip: Remember to multiply the quarterly dividend provided in the question by 4.

SIE Roadblock #6: Applying Concepts

Candidates can expect that approximately 25% of their exam questions will move beyond mere definitions and tie together various concepts and/or address suitability issues with a given product. Here are a few scenarios where it’s necessary to combine various concepts to address an issue.

Example #1: The Influence of FRB Policy

Candidates should be familiar with FRM tools and the concepts of FRB tightening (raising rates) and loosening (lowering rates). The exam could employ slang terminology in this area. Tightening becomes the FRB being hawkish, and loosening is referenced as the FRB being dovish.

If the FRB is hawkish, investors should shorten their maturities. Why?

Candidates must combine three facts to get the right answer.

- Hawkish means rising rates.

- Rising rates translate into lower future bond prices based on the inverse relationship between yield and price.

- Short-term bonds will be hurt less by rising rates due to their lesser relative price volatility when compared to long-term issues. Remember, maturity magnifies the price move.

Dovish is the opposite expectation and implies potentially lower future interest rates and higher future bond prices. If this is the expectation, bond investors should lengthen maturities to take advantage of the anticipated upward positive price movement in bonds.

Example #2: Selecting the Correct Bond

A second example of the extension beyond definitions could be the exam writer providing a brief description of the client and then asking a question about the appropriate debt security recommendation. There will be hints in the question such as the person’s age, job, income, risk tolerance, investment horizon, and so on.

To get these questions correct, you need to have a firm grasp of the relative safety profile and tax status of each debt instrument. For example:

- High earners should be steered toward municipals because of the tax-free status of these issues’ coupons.

- Safety seekers should consider treasuries due to these issues’ default-free status.

- Middle-of-the-road investors (middle-aged, average incomes) might be best served with an investment in a high-grade corporate bond issue.

If you encounter an investor who appears to want equity exposure as well, go with the convertible corporate bond since this will provide indirect appreciation potential. If the question leads with a client’s near-immediate need for funds, choose the shortest maturity conservative investment.

Ready to Get Started Preparing for the SIE Exam?

Kaplan's digital-first SIE exam study packages offer expert instruction and realistic study materials to help you succeed on the exam. Our enhanced SIE course uses an innovative blended learning approach to introduce securities concepts and reinforce exam prep best practices. Each course includes micro-learning videos, questions, resource links, and exam simulation.What is the SIE Exam?

The SIE exam is a required qualifications exam administered by FINRA. It tests basic information including products, risks, the structure & function of the securities industry & its regulatory agencies, and knowledge of regulated & prohibited practices.

TABLE OF CONTENTS

Why FINRA Introduced the SIE Exam

FINRA developed the SIE exam for two primary reasons. First, the organization recognized that across many of their series-specific exams, there were questions covering the same introductory topics. As a result, candidates who sat for multiple securities exams throughout their careers were being tested on the same material multiple times.

So FINRA decided to pull these topics out from those series-specific exams and use them to form the SIE exam.

The second reason FINRA created the SIE exam was to remove a significant barrier to entry into the securities industry.

Who Can Register For the SIE Exam?

Anyone 18 or older including students and prospective candidates interested in demonstrating basic industry knowledge to potential employers can register to sit for the SIE exam. Individuals do not need to be sponsored by an employing brokerage to sit for the SIE exam like other FINRA series-specific exams.

Download the free eBook, A Candidate's Complete Guide to the SIE Exam, for more valuable information about the test contents and the securities licensing process.

SIE Exam Details

This section provides an overview of the SIE exam format, content, and scoring.

SIE Exam Format

The SIE exam is 1 hour and 45 minutes long and contains 75 scored questions in multiple-choice format. The exam also contains 10 unscored questions which are randomly distributed throughout the exam and do not count towards your score. The exam consists of four topic sections which carry different weights in a candidate's score.

SIE Exam Topics and Weights

The SIE exam consists of several topics that contribute differently to your overall score. Here's a breakdown of the topics, their weightage in the exam score, and the number of questions associated with each topic:

SIE Exam Topics | # of Questions | Topic Weights |

| Knowledge of Capital Markets | 12 questions | 16% |

| Understanding Financial Products and their Risks | 33 questions | 44% |

| Understanding Trading, Customer Accounts, and Prohibited Activities | 23 questions | 31% |

| Overview of Regulatory Framework | 7 questions | 9% |

SIE Exam Dates

The SIE exam is offered year-round, and you can schedule your exam within 120 days of registering.

How is the SIE Exam Scored?

To pass the SIE exam, you need a score of 70. All scores are adjusted to account for slight variations in difficulty between different exam versions. This ensures everyone is held to the same standard, regardless of which questions they get. There's no penalty for guessing, so answer every question within the time limit.

How Hard is the SIE Exam?

While the SIE exam is an entry-level exam, it’s important to take it seriously and dedicate yourself to preparing successfully. The SIE exam covers a broad range of foundational financial topics including capital markets, financial products, trading, regulations, and more.

Setting yourself up with successful studying plans is key to increasing your chance of passing the exam on your first attempt. SIE pass rates historically have been around 90% for students who enroll in an SIE exam prep class.

How to Register for the SIE Exam

To register for the SIE exam, candidates should create an account with FINRA. After getting your account set up, you’ll need to pay the $80 USD fee and schedule your exam within a 120-day window.

You will be able to schedule an appointment with Prometric to take the exam at a local test center or online with a remote proctor.

How to Study for the SIE Exam

As you begin to prepare for the SIE exam, start by assessing your financial knowledge. Try taking a diagnostic practice exam to gauge your familiarity with the exam content. Use the results of your diagnostic exam as a guide to help you determine your strengths and weaknesses.

Try Today’s Featured SIE Exam Practice Question

Once you’ve identified the topic areas you need to focus on, develop a study schedule that gives you enough time to dedicate a few hours a week to learning the exam curriculum. After spending some time learning the material, dedicate a few hours to practice applying your knowledge and performing under exam-like conditions with realistic study materials.

Tips for Passing the SIE Exam >>

After You Pass the SIE Exam: What’s Next?

While passing the SIE exam is a crucial first step, it's not enough on its own to work in the securities industry. To become registered to engage in the securities business, individuals must also pass a specialized qualification exam relevant to their desired field. Additionally, they need to be sponsored by a FINRA member firm to take this qualification exam.

Below are the exams you can take to become qualified to engage in the securities business after passing your SIE exam:

- Series 6 – Investment Company Representative (IR)

- Series 7 – General Securities Representative (GS)

- Series 22 – DPP Representative (DR)

- Series 57 – Securities Trader (TD)

- Series 79 – Investment Banking Representative (IB)

- Series 82 – Private Securities Offerings Representative (PR)

- Series 86 and 87 – Research Analyst (RS)

- Series 99 – Operations Professional (OS)

Ready to Get Started Preparing for the SIE Exam?

Find SIE exam success in one of our digital-first SIE exam study packages. Receive expert instruction, and realistic SIE Exam study materials to help you grasp foundational concepts of the securities industry.NASAA Adopts Investment Adviser Representative Continuing Education Model Rule

The Continuing Education Model Rule for Investment Adviser Representatives (IARs) has multiple implications and effects for professionals throughout the financial services industry. Read more about the IAR Continuing Education (CE) Model Rule, who it will impact, where it is in effect, related requirements, and more.

What is Investment Adviser Representative Continuing Education (IAR CE?)

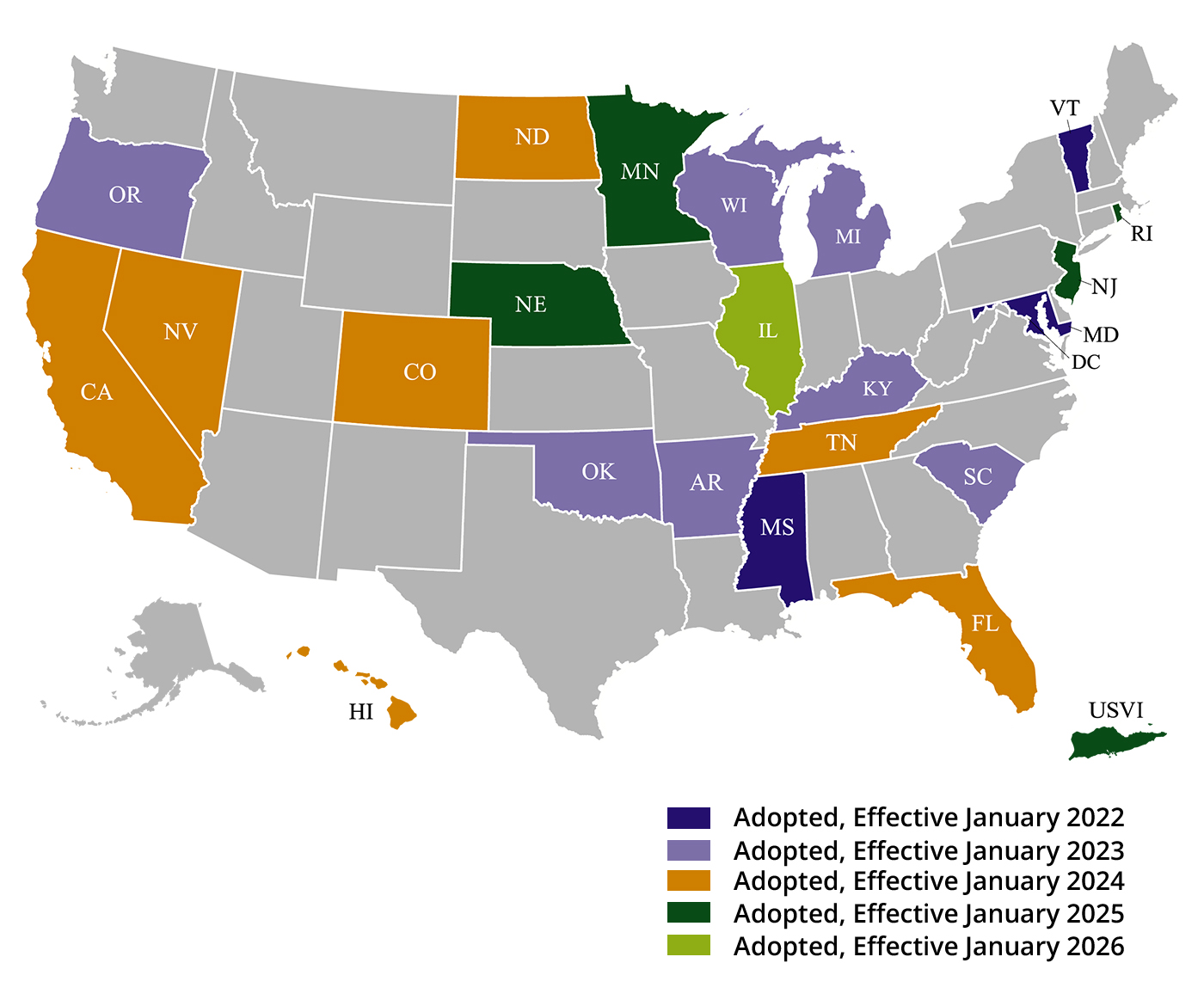

IAR CE is an annual continuing education requirement for IARs governed by the NASAA Model Rule on Continuing Education which was adopted in 2020 and implemented by states and jurisdictions beginning in 2022.

Why Was the IAR CE Model Rule Adopted?

NASAA’s membership, with strong industry support, adopted the IAR CE Model Rule to address the lack of a continuing education requirement for IARs in contrast to other financial services professionals. These types of professionals are often required to maintain or expand their level of knowledge and competence after initial qualification, which is what the IAR CE Model Rule will now accomplish for IARs.

Who is the IAR CE For?

Any Investment Adviser Representative (IAR) who is registered in a state or jurisdiction that has adopted the NASAA IAR CE Model Rule will be subject to its new CE requirements.

FINRA and IAR CE

For dual registrants, IARs who are also registered agents of BD firms, completion of the FINRA CE Regulatory Element may be applied to meet the Products and Practices component of the IAR CE requirement.

FINRA CE Firm Element training may also be applied to meet the IAR CE requirement if the training is approved by NASAA.

Professional Designation CE courses (CFP®, ChFC®, CFA®, PFS, CIC) are also eligible for IAR CE credit as long as they are approved by NASAA.

When Did the IAR CE Model Rule Go Into Effect?

The IAR CE Model Rule went into effect beginning in 2022.

State by State: Where is the IAR CE Model Rule in Effect?

State | Status | Effective Date |

Mississippi | Adopted | January 1, 2022 |

Vermont | Adopted | January 1, 2022 |

Maryland | Adopted | January 1, 2022 |

Michigan | Adopted | January 1, 2023 |

Wisconsin | Adopted | January 1, 2023 |

Kentucky | Adopted | January 1, 2023 |

| Oklahoma | Adopted | January 1, 2023 |

| Washington DC | Adopted | January 1, 2023 |

| South Carolina | Adopted | January 1, 2023 |

| Arkansas | Adopted | January 1, 2023 |

| Oregon | Adopted | January 1, 2023 |

| Colorado | Adopted | January 1, 2024 |

| Tennessee | Adopted | January 1, 2024 |

| Nevada | Adopted | January 1, 2024 |

| Florida | Adopted | January 1, 2024 |

| North Dakota | Adopted | January 1, 2024 |

| California | Adopted | January 1, 2024 |

| Hawaii | Adopted | January 1, 2024 |

| US Virgin Islands | Adopted | January 1, 2025 |

| Rhode Island | Adopted | January 1, 2025 |

| New Jersey | Adopted | January 1, 2025 |

| Nebraska | Adopted | January 1, 2025 |

| Minnesota | Adopted | January 1, 2025 |

| Illinois | Adopted | January 1, 2026 |

IAR CE Requirements

IARs are required to complete 12 hours of CE credit per year in order to maintain their IAR registration. This includes 6 hours of Products and Practices and 6 hours of Ethics and Professional Responsibility. An IAR taking more than 12 credit hours per year is not allowed to carry forward those excess credits into the following year.

Courses cannot be repeated. CRD tracking will include duplicate courses in the course transcript section if reported, but duplicate courses will not count toward the IAR CE requirement, even if completed in another year.

Kaplan provides both individual courses and a Total Access CE Library to help you fulfill this requirement.

What's the Deadline for Submitting Course Completion Rosters to Ensure They're Processed in 2025?

December 26th, 2025 at 4:00 pm ET. Any rosters submitted before this date will be processed as part of the 2025 renewal process. You must complete your CE courses prior to this date to ensure they are reported before the end of the year.

Can Course Rosters Still Be Submitted Between December 26th After 4:00 pm ET and December 31st, 2025?

Yes, the system will accept rosters during this time. However, they won't be processed until the system resumes operation on January 2nd, 2026, and registration statuses for individuals who are CE Inactive at 4:00 pm on December 26th will immediately advance to Fail to Renew (FTR). If an individual is FTR due to deficient CE on December 26th, their registration status will not update and will remain FTR until the CE deficiency is cleared and a new U4 is filed to re-register with the state.

Will Your 2026 Registration Be Affected if You Wait Until the System Downtime to Complete Your CE?

Expert Tip: It's crucial to stay on top of CE requirements and meet all deadlines to avoid registration issues.

Approved IAR CE Course Providers

IARs are required to take NASAA-approved CE courses from approved course providers. Any vendor, firm, individual, or state may provide CE so long as the provider and course are approved. The list of approved course providers—including Kaplan—can be found here.

IAR CE Costs

NASAA has implemented a course reporting fee of $3 per credit hour. Therefore in addition to any training costs, an IAR can expect to pay $36 per year to meet their CE requirement.

How Can I Check My IAR CE Status?

You can use the Financial Professional Gateway (FinPro) to review your IAR CE status, track completed courses, and more.

Learn more about Kaplan's course offerings here.

SEC Shortening Trade Settlement Cycle from T+2 to T+1

The SEC announced in 2023 that trade settlement will be reduced from T+2 to T+1 in 2024. The SEC set compliance with the new T+1 rule to begin on May 28, 2024. The 15-month period was given to provide time for firms to make the needed adjustments to comply with the new rule. The self-regulatory organizations (e.g., FINRA, MSRB, OCC) have adopted this change as well.

What is the Settlement Cycle?

When selling or purchasing securities there is a cutoff date when the securities traded must be delivered by the selling side and paid for by the purchasing side. That date for most corporate securities is fixed under a set of rules called the Uniform Practice Code. Regulators and the various stock exchanges all agree to operate under this code. The most common settlement arrangement is called regular way and it currently calls for settlement on the second business day from the trade date; what is commonly known as T+2.

When is the Settlement Cycle being Shortened from T+2 to T+1?

With the passage of the Securities Acts Amendments of 1975, Congress empowered the SEC with the authority to change the trade settlement cycle. Eighteen years later, in 1993, the Commission used that authority to again shorten the settlement cycle from T+5 business days to T+3. The SEC then shortened from T+3 to T+2 on the first full day of spring, 2017. The change in 2024 is the first alteration of the settlement cycle since then.

Why is the Settlement Cycle being Shortened from T+2 to T+1?

Benefits of the Settlement Cycle being Shortened from T+2 to T+1

The pandemic year of 2021 intensified the strain of volatility and trading volume, coupled with the enormous number of transactions in “meme” stocks. With that volume came higher margin requirements on retail brokerage, leading to restricted trading in those stocks, leaving some investors unable to purchase stocks at a critical time.

The Commission is confident that shortening the settlement cycle—from T+2 to T+1, plus the corresponding move to accelerate settlement to T+0—as technology allows will further

enhance our trading markets.

Concerns about the Settlement Cycle being Shortened from T+2 to T+1

Apart from the more widely understood future need to deliver securities and funds one day earlier, there are other concerns to the shortened cycle, which includes:

- Fails-to-deliver

- Fails-to-receive

- the process of reclamation

- Regulation SHO

- Buy-ins

- sell-outs and

- other settlement methods such as DVP/RVP.

These are just some of the issues that are affected by the change and appear on certain qualification exams.

How Member Firms Must Respond to the Shortened Settlement Cycle

Because settlement weaves itself throughout industry practices and processes, we at Kaplan will be looking at the hundreds of ways shortened settlement will impact Licensing Exam Manuals and practice test questions through our many study programs. The day T+1 goes into effect, we will be ready, and our students may look forward to being fully equipped with the latest, most up-to-date materials.

How to Get Your Series 65 License

The Series 65 license, known as the Uniform Investment Adviser Law Examination, qualifies individuals to provide investing and general financial advice to clients. Passing the Series 65 exam qualifies individuals as Investment Advisor Representatives (IARs).

Obtaining the Series 65 license is important for representatives who provide advice on ERISA-regulated retirement retirement accounts.

A recent College for Financial Planning report indicated 84% of financial professionals training related to practical soft skills, such as how to market yourself and communicate with clients as important as they develop their careers.*

How to Get the Series 65 License

Unlike many other FINRA Series exams, the Series 65 exam does not require an individual to be sponsored by a member firm. If you are not Form U4 registered or affiliated with a firm through FINRA’s Web CRD system, you should use the Form U10 to request and pay for the Series 65 exam. There is an exam fee that is commonly covered by the sponsoring firm if you are Form U4 registered, or by the individual if you are not sponsored.

Thinking about a career in securities? Download our free eBook, Launching Your Securities Career, to get tips and advice from 100+ securities professionals.

Series 65 License Exam Format

The exam consists of 130 multiple-choice questions, and you have 3 hours to complete it. To pass the exam, you must get at least 92 out of 130 scored questions correct. In other words, you need just over 70% to pass.

Series 65 License Exam Curriculum

The exam covers four topic areas:

- Economic factors and business information

- Investment vehicle characteristics

- Client investment recommendations and strategies

- Laws, regulations, and guidelines on unethical business practices

In June 2023, NASAA added new content to the exam to better reflect the skills and knowledge needed to be an IAR today. Some new specifications emphasize the characteristics of different types of investments, including SPACs, blind pools, blank check companies, non-liquid REITs, and digital assets. Alternative investments were also updated to better reflect the changing marketplace. In addition, new areas were added to highlight the importance of CE for IARs, exploitation of seniors and vulnerable adults, and Regulation BI. Updates were also added for recent regulatory changes in the Secure Act 2.0.

While the passing score was decreased, the weighting of topics, number of questions, and length of the exam were not changed. Visit NASAA to view the most up-to-date content outline.

Ready to Start Your Series 65 Licensing Exam Prep?

Browse our website to learn more about our live and online study options, series 65 study materials, and to purchase a Series 65 exam prep package.

-----

*This is one of the findings of a quantitative survey conducted by the College for Financial Planning®—a Kaplan Company between June 27 and August 7, 2023. For this survey, a sample of 951 2022 and 2023 graduates of the College for Financial Planning was interviewed online in English.

How to Get Your Series 7 License

What is a Series 7 license? Known as the General Securities Registered Representative license, this license allows you to sell a broad range of securities. A holder is allowed to sell corporate stocks and bonds, municipal bonds, mutual funds, variable annuities, options, direct participation program (DPP) partnerships, and packaged securities (i.e., collateralized mortgage obligations).

The Series 7 is generally preferred by banks and broker dealers for new recruits coming directly into the financial services industry. Those who get this license are officially listed as registered representatives by FINRA, but are more commonly referred to as stockbrokers.

Steps to Earn Series 7 License

Below are the four steps to earning your Series 7 License.

Step 1: Take and Pass the SIE Exam

The SIE exam tests common topics such as fundamentals, regulatory agencies and their functions, product knowledge, and acceptable and unacceptable practices. You can take the SIE exam before being sponsored by a firm and even while you are still in school. You have a four-year window in which to take and pass any of the representative level top-off exams, like Series 7, after passing the SIE exam. Note that FINRA says that the SIE and Series 7 exams are "corequisites," which does not mean you have to take them at the same time. What FINRA means is that you have to pass both to get your license, but you can take them in any order.

Download "A Candidate's Guide to the SIE Exam" to take your first step toward SIE Exam success.

Step 2: Secure a Sponsorship

To take the Series 7 exam, you must be sponsored by a FINRA member firm or a self-regulatory organization (SRO). Firms apply for candidates to take the exam by filing a Uniform Application for Security Industry Registration or Transfer (Form U4). There is also an exam fee that is commonly covered by the sponsoring firm.

A recent College for Financial Planning report indicated 84% of financial professionals training related to practical soft skills, such as how to market yourself and communicate with clients as important as they develop their careers.*

Step 3: Study for the Series 7 Exam

Once you secure your sponsorship, you can take the top-off exam for the Series 7 license. Most candidates also choose to take the SIE before they take the Series 7, but you can take it first if you prefer and the SIE afterwards.

The licensing exam is not exactly a walk in the park. You need to study with purpose and planning. To help you out, many retail brokerage firms have an in-house training program or, in some cases, they have an agreement with an external training provider. Series 7 study materials go a long way toward helping you pass your Series 7 exam the first time.

Series 7 Exam Format

The exam consists of 125 multiple-choice questions, and you have 3 hours and 45 minutes to complete it.

The following table shows the major job functions covered by the exam (1 through 4) with the associated number of questions:

| Function Description | % of Exam | # of Questions |

| 1 - Seeks Business for the Broker Dealer from Customers and Potential Customers | 7% | 9 |

| 2 - Opens Accounts after Obtaining and Evaluating Customers' Financial Profile and Investment Objectives | 9% | 11 |

| 3 - Provides Customers with Information About Investments, Makes Suitable Recommendations, Transfers Assets and Maintains Appropriate Records | 73% | 91 |

| 4 - Obtains and Verifies Customers’ Purchase and Sales Instructions and Agreements; Processes, Completes and Confirms Transactions | 11% | 14 |

| TOTAL | 100% | 125 |

Step 4: Pass the Series 7 Exam

FINRA makes it easy to enroll for your exams, because they also administer the exams for your NASAA licenses. Simply visit this page.

The passing score for the exam is 72%. For more in-depth coverage of these functions and how the exam is set up, check out this article. Once you pass the exam, you have your license.

Ready to Start Preparing for the Series 7 Exam?

Series 7 licensing exam prep can really give you the edge you need to pass. Learn more about our live and online study options, and how to purchase a Series 7 exam prep.

----

*This is one of the findings of a quantitative survey conducted by the College for Financial Planning®—a Kaplan Company between June 27 and August 7, 2023. For this survey, a sample of 951 2022 and 2023 graduates of the College for Financial Planning was interviewed online in English.

How to Get Your Series 6 License

A recent College for Financial Planning report indicated 84% of financial professionals training related to practical soft skills, such as how to market yourself and communicate with clients as important as they develop their careers.The Series 6 license, known as the Investment Company/Variable Contracts Products Limited Representative License, allows you to register as a limited representative with FINRA. With a Series 6 license, you are able to sell mutual funds, variable annuities, variable life insurance, unit investment trusts (UITs), and municipal fund securities.

The Series 6 is often seen as the ideal companion license for those in the insurance industry. Holders are able to expand the financial products and services they offer, as well as increase their level of expertise.

Steps to Earn Series 6 License

Below are four simple steps to earning a Series 6 License.

Step 1: Take and Pass the SIE Exam

The SIE exam tests common topics such as fundamentals, regulatory agencies and their functions, product knowledge, and acceptable and unacceptable practices. You can take the SIE exam before being sponsored by a firm and even while you are still in school. You have a four-year window in which to take and pass any of the representative level top-off exams, like Series 6, after passing the SIE exam. Note that FINRA calls the SIE and Series 6 exams "corequisites," but they do not mean you have to take both at the same time. Instead, they mean you have to take both to earn your license, and you can take them in any order.

Download "A Candidate's Guide to the SIE Exam" to take your first step toward SIE Exam success.

Step 2: Secure a Sponsorship

To take the Series 6 exam, you must be sponsored by a FINRA member firm or a self-regulatory organization (SRO). Firms apply for candidates to take the exam by filing a Uniform Application for Security Industry Registration or Transfer (Form U4). There is also an exam fee that is commonly covered by the sponsoring firm.

A recent College for Financial Planning report indicated 84% of financial professionals training related to practical soft skills, such as how to market yourself and communicate with clients as important as they develop their careers.*

Step 3: Take and Pass the Series 6 Exam

Once you secure your sponsorship, you can then take the top-off exam for the Series 6 license. Most candidates will choose to take the SIE before the Series 6, but it is also possible to take it after.

Series 6 Exam Format

The exam has 50 questions broken down into four functions:

- Function 1: Seeks Business for the Broker-Dealer from Customers and Potential Customers, 12 questions, 24% of exam items

- Function 2: Opens Accounts after Obtaining and Evaluating Customers’ Financial Profile and Investment Objectives, 8 questions, 16% of exam items

- Function 3: Provides Customers with Information About Investments, Makes Suitable Recommendations, Transfers Assets and Maintains Appropriate Records, 25 questions, 50% of exam items

- Function 4: Obtains and Verifies Customers’ Purchase and Sales Instructions; Processes, Completes and Confirms Transactions, 5 questions, 10% of exam items

The test time is 1 hour and 30 minutes and the passing score is 70 percent and above.

Step 4: Register Your License

After you pass your licensing exam, you’ll have to register your Series 6 license with FINRA and an approved broker-dealer, who will hold your license and oversee your business for a portion of the commission income.

Ready To Start Preparing for the Series 6 Licensing Exam?

Series 6 licensing exam prep can really give you the edge you need to pass. Learn more about our live and online study options to purchase a Series 6 exam prep package.

-----

*This is one of the findings of a quantitative survey conducted by the College for Financial Planning®—a Kaplan Company between June 27 and August 7, 2023. For this survey, a sample of 951 2022 and 2023 graduates of the College for Financial Planning was interviewed online in English.

How to Get a Securities License

So, you’ve earned—or are about earn—a bachelor’s or master’s degree in finance or a related field, and you’ve decided to sell securities. Or, you’ve decided to add securities to your financial services or insurance repertoire. Now that you have charted your path, the next step is earning the licenses you need to practice your profession.

Steps to Get a Securities License

Below are five steps to getting a securities license.

Step 1: Get to Know FINRA and NASAA—If You Haven’t Already

Financial Industry Regulatory Authority (FINRA) is the organization in charge of securities licensing and requirements, and it also administers most of the exams you’ll need to pass to get your license. FINRA also keeps all securities licensing records, writes and enforces rules governing the activities of broker-dealers, audits firms for compliance with those rules, fosters market transparency, and educates investors.

North American Securities Administrators Association (NASAA) is the association of state securities administrators who are charged with the responsibility of protecting consumers who purchase securities or investment advice. Its members participate in enforcement actions and share information, and it also coordinates training and education for state, district, provincial, and territorial securities agency staff. NASAA oversees the licensing requirements for three of the required securities license types.

Thinking about a career in securities? Download our free eBook, Launching Your Securities Career, to get tips and advice from 100+ securities professionals.

It’s important to get to know these organizations and keep up with their activities. For example, effective October 1, 2018, a new exam and licensing structure from FINRA will go into effect. The updated structure adds a new exam—the Securities Industry Essentials (SIE) exam—which anyone who wants to earn their first license after that date will have to pass. After passing that exam, the individual licensing exams will be considered “top-offs” and apply directly to the securities license you want to hold. The good news is that you don’t have to be registered or sponsored by a brokerage firm to take the SIE exam.

Step 2: Determine Whether You Should Take the SIE Exam

If you plan to earn a Series 6, Series 7, Series 79, and Series 99, you will also have to pass the SIE. These individual licensing exams are considered “top-offs” and apply directly to the securities license you want to hold. The good news is that you don’t have to be registered or sponsored by a brokerage firm to take the SIE exam. You may also take it while still in school. The other good news is that if you prefer, you can take your "top-off" exam first, if you wish, and the SIE afterwards.

Step 3: Determine Which Securities License or Licenses You’ll Need

You can’t sell securities at a brokerage firm without being licensed. The types of licenses you’ll need depend on the brokerage that’s hiring or sponsoring you. Most of those who hire or train new advisors will have a mandatory licensing program included in their training package, and almost all firms mandate which securities licenses must be obtained to sell the company's products and services. If you intend to be a Registered Investment Advisor or an independent broker-dealer, you’ll also need to be licensed.

Most Common FINRA and NASAA Securities Licenses

- Series 6: If you want to sell mutual funds, variable annuities, and other investment packages, you’ll need this license. Administered by FINRA and known as the limited-investment securities license, the Series 6 license enables you to sell what are known as packaged investment products. If you’re an insurance agent who wants to sell variable products, you’ll also need this license.

- Series 7: If you’d like to be a stockbroker, this is the license for you. Administered by FINRA and known as the general securities representative license, the Series 7 license authorizes you to sell virtually any type of individual security, such as preferred stocks, options, bonds, and other individual fixed income investments—plus all forms of packaged products. Basically, this license enables you to sell everything except commodities futures, real estate, and life insurance.

- Series 3: If you want to sell commodity futures contracts, you need the Series 3 license, also administered by FINRA.

- Series 31: If you want to sell managed futures, which are pooled groups of commodities futures, you’ll need the Series 31 license, an offshoot of the Series 3 license.

- Series 63: If you have a Series 6 license or a Series 7 license, and you want to do business as a stockbroker or sell mutual funds in any state, you need this license. Administered by NASAA, Series 63 is known as the Uniform Securities Agent license.

- Series 65: If you want to be a financial planner or advisor who works for an hourly fee rather than a commission, or you want to be a stockbroker or other financial representative who deals with managed-money accounts, you’ll need this license. It’s also administered by NASAA.

- Series 66: If you have a Series 7 license, you have already answered a good portion of the Series 65 exam, so instead of earning Series 63 and Series 65 separately, you can choose to hold this license instead.

- Series 79: If you want to offer advice or facilitate debt or equity offerings (public or private), mergers or acquisitions, tender offers, final restructuring, asset sales, and divestitures or corporate reorganizations, you’ll need this license.

- Series 99: If you plan to be a senior manager or a supervisor in operations or will have the authority to materially commit capital in various back office functions, you need this license.

These are the most common securities licenses. You can find a more comprehensive list at the FINRA and NASAA websites. Keep in mind that to earn some of these licenses, like the Series 6 and Series 7, you will need to be sponsored by or work for a broker-dealer.

If you work for a company, take advantage of financial education and training programs offered by them, which make include Securities Licensing exam prep. According to a recent College for Financial Planning report, 79% of financial professionals say financial education and training programs offered by their company is important as they are developing their careers.*

Step 4: Check Your State Requirements

There might be additional requirements for selling securities in your state or the state where you want to be licensed. You should check with the respective office of the Secretary of State to learn about anything else you need to do to earn your securities license.

Step 5: Study for and Take the Exams—and Pass

To earn your Series 6, 7, 22, 57, 79, 82, and 99 license, you’ll need to pass the SIE exam and take the FINRA “top-off” exam for each license type. FINRA says that the exams are "corequisites," but that does not mean you have to take both at the same time. Instead, they mean that you can't earn your license without taking both, and you can take them in any order.

The licensing exams are not exactly a walk in the park. You need to study with purpose and planning. To help you out, many retail brokerage firms have an in-house training program or, in some cases, they have an agreement with an external training provider. Exam preparation and review courses go a long way toward helping you pass your exams the first time.

FINRA makes it easy to enroll for your exams, because they also administer the exams for your NASAA licenses. Simply visit this page.

When you have completed an exam, the computer screen will indicate whether you’ve passed or failed the exam. It also presents a score profile that shows your performance based on the job responsibilities covered by the exam. The percentage required for passing varies. To pass the Series 7, 63, and 65 exams, you need a score of 72%. To pass the Series 66, you need a 73%. You should research your particular exam to find out what the passing score is, because it can change.

What’s Next?

After you pass your licensing exams, you’ll have to register your licenses with FINRA and an approved broker-dealer, who will hold your securities licenses and oversee your business for a portion of the commission income. If you intend to be a Registered Investment Advisor, you don’t have to be associated with a broker-dealer. However, you must register with the state you are doing business in if you’re managing assets that are less than $100 million or with the SEC if they are more than $100 million.

Ready to Go?

If you’ve already decided which licenses you’ll need, visit our resources page for information on how to pass each type of licensing exam. You can also view our education and exam preparation packages here.

---

*This is one of the findings of a quantitative survey conducted by the College for Financial Planning®—a Kaplan Company between June 27 and August 7, 2023. For this survey, a sample of 951 2022 and 2023 graduates of the College for Financial Planning was interviewed online in English.

Latest NASAA Exam Updates

On February 6, 2023, the North American Securities Administrators Association (NASAA) announced changes to three exams. The Series 63, 65, and 66 exams will have updated content coverage and topic weightings for any exam administered on or after June 12, 2023.

More information about preparing for the Series 63 Exam Prep

More information about preparing for the Series 65 Exam Prep

More information about preparing for the Series 66 Exam Prep

Series 63, Series 65, and Series 66 Exam Weight Changes

Below are the current exam weights for each topic and what the new topic weights will be after the changes are made on or after June 12, 2023.

Series 63 Exam Topic Weight Changes

Curriculum Topic | Current Topic Weight and Number of Questions | New Topic Weight and Number of Questions |

Regulation of Investment Advisers Including State-Registered and Federal | 5%, 3 | 5%, 3 |

Regulation of Investment Adviser Representatives | 5%, 3 | 5%, 3 |

Regulation of Broker-Dealers | 15%, 9 | 12%, 7 |

Regulation of Agents of Broker-Dealers | 15%, 9 | 13%, 8 |

Regulation of Securities and Issuers | 5%, 3 | 9%, 5 |

Remedies and Administrative Provisions | 10%, 6 | 11%, 7 |

Communication with Customers and Prospects | 20%, 12 | 20%, 12 |

Ethical Practices and Obligations | 25%, 15 | 25%, 15 |

Series 65 Exam Topic Weight Changes

Curriculum Topic | Current Topic Weight and Number of Questions | New Topic Weight and Number of Questions |

Economic Factors and Business Information | 15%, 20 | No Changes |

Investment Vehicle Characteristics | 25%, 32 | No Changes |

Client Investment Recommendations and Strategies | 30%, 39 | No Changes |

Laws, Regulations, and Guidelines Including Prohibition on Unethical Business Practices | 30%, 39 | No Changes |

Series 66 Exam Topic Weight Changes

Curriculum Topic | Current Topic Weight and Number of Questions | New Topic Weight and Number of Questions |

Economic Factors and Business Information | 5%, 5 | 8%, 8 |

Investment Vehicle Characteristics | 20%, 20 | 17%, 17 |

Client/Customer Investment Recommendations and Strategies | 30%, 30 | 30%, 30 |

Laws, Regulations, and Guidelines Including Prohibition on Unethical Business Practices | 45%, 45 | 45%, 45 |

Series 63, 65, and 66 Exam Question Changes

The total number of questions on the Series 63, 65, and 66 exams are not changing. For each of the three exams, the number of questions will remain the same.

Exam Content Outline Changes on Series 63, 65, and 66 Exams

The content outline is not changing for the Series 65 exam. The structure will be very similar for the Series 63 and Series 66 exams.

Content Outline Updates for Series 63 Exam

For the Series 63 exam, Regulation of Broker-Dealers (2) and Regulation of Agents (1) have 3 fewer questions but there are 2 more on Regulation of Securities and Issuers and 1 more on Remedies and Administrative Provisions.

Content Outline Updates for Series 66 Exam

For the Series 66 exam, Economics and Business Information has been increased from 5 to 8 questions. Correspondingly, Investment Vehicle Characteristics has been reduced from 20 to 17 questions.

Score Changes To Series 63, 65, and 66 Exams

The Series 63 and Series 66 will not have any scoring updates. The Series 65 will be updated to require candidates to submit 92 correct answers instead of 94 in order to receive a new passing score of 70%, reduced from 72%.

Content Updates To Series 63, 65, and 66 Exams

There are no changes to the content in the Series 63 exam. The Series 65 and Series 66 exams will have additional material, as well as updates for recent regulatory changes in the Secure Act 2.0. Most of the additions will be identical with two exceptions.

Added to the Series 66 exam is Business Continuation and Succession which, up until now, has been only in the Series 65.

The portion on Investment Vehicle Characteristics for the Series 66 now contains information about many of the topics covered in the Series 65. For example, ADRs and the different types of preferred stock will be tested. Money market instruments and incentive and nonqualified employee stock options are also testable.

Summary of Content Additions to Series 65 and 66 Exams

Predominantly, the additional material reflects changes in the advisory world.

Special purpose acquisition companies (SPACs)/blind pools/blank check companies

Non-liquid REITs

Digital assets (distinction, characteristics, and risks; securities, currencies, and assets)

As part of the client profile, values including environmental, social, and governance (ESG) and religious criteria

Government benefit implications (e.g. income related monthly adjustment amounts)

Donor advised funds

Recommendations meeting a standard of care (essentially, Regulation BI)

Payment for order flow and distinguishing between introducing and clearing broker-dealers

Continuing education requirements for IARs

Exploitation of vulnerable adults

Summary of Content Deletions to Series 65 and 66 Exams

Some examples of what is being deleted from the Series 65 and 66 content are:

viatical/life settlements

investment real estate

dark pools

How Kaplan is Responding to NASAA Exam Changes

Kaplan will release addendums to current Series 65 and 66 material to cover all new content in Student Dashboards under Updates/Corrections by June 1. No addendum will be needed for the changes to the Series 63, as the current study materials have full topic coverage.

On June 12, we will transition our SecuritiesProTM QBank, simulated exams, and practice exams to reflect the new test weights and covered content.

Frequently Asked Questions About NASAA Exam Changes

Below are common questions we receive about how Kaplan responds to NASAA exam changes.

If I take the exam before June 12 and do not pass, will my retake exam include the new material or the material covered on my initial test?

From June 12 on, any exam administered, whether a first attempt or a retake, will follow the new content and structure.

After the changeover, will NASAA make available the questions from the previous question bank?

NASAA, like FINRA, never releases retired questions. Questions on the few areas deleted from the content outlines will no longer be used on securities exams.

How To Ask More Questions About NASAA Exam Changes

If you are a current user of one of our study packages and have any content questions along the way, just send us an email through InstructorLink located on your homepage.

If you are not a current user of one of our study packages contact our support or service teams, by calling 877.731.5061.

Changes in SEC Regulation A and Regulation D

On March 15, 2021 certain important SEC rule changes went into effect.

SEC Regulation A

What is new?

The regulation now provides two offering tiers for both U.S. and Canadian issuers.

Tier 1 securities offerings up to $20 million in a 12-month period, including no more than $6 million sold on behalf of selling shareholders. Subject to a coordinated review by states and the SEC. The issuer must file Form 1-A (greatly simplified from the complex Form S-1) along with two years of financial statements. There is no need for these statements to be audited.